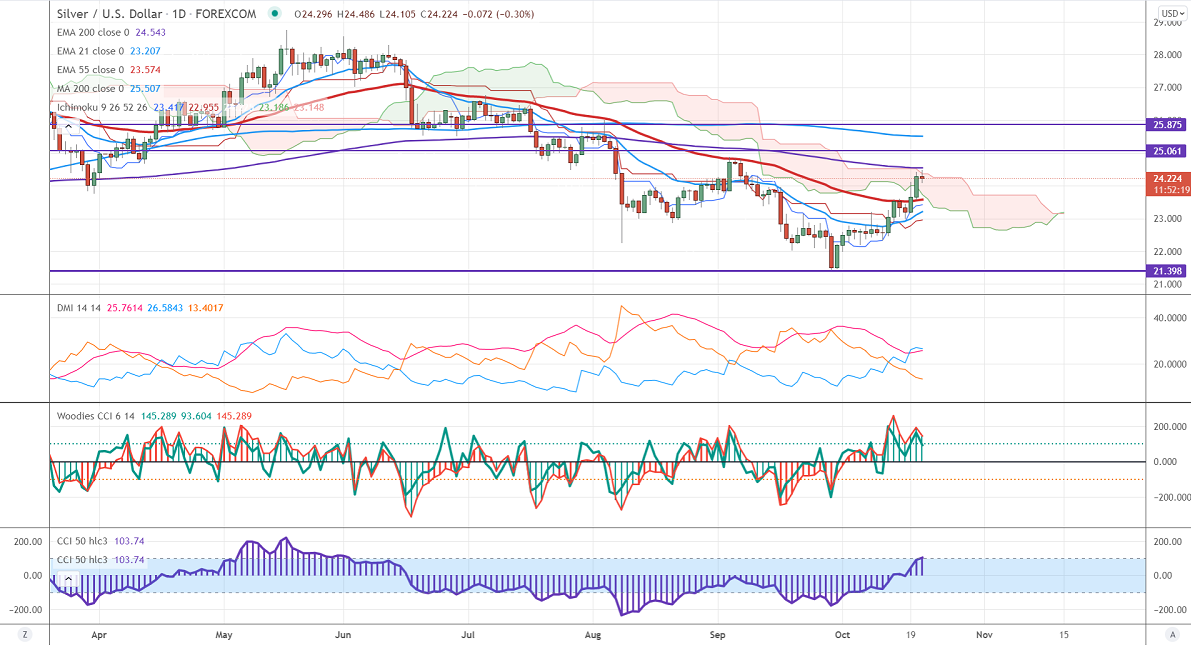

Ichimoku analysis (Daily chart)

Tenken-Sen- $22.38

Kijun-Sen- $22.92

Silver was one of the worst performers in the past four months and lost more than 23% on board-based US dollar buying. The US dollar index has formed a temporary bottom at 89.53 in May 2021 and surged to 94.50 level. The commodity pared some of its losses made in the previous month despite rising in US treasury yields. Short -term trend is still bullish as long as support $21.40 holds. Silver was one of the best performers during the corona pandemic and surged more than 150% on increasing demand.

Technically, silver's significant support is around $23.55, violation below will drag the pair down to $23/$22.34/$22. The near-term resistance is at $24.60, any surge past targets $25/$25.50.

It is good to sell on rallies around $28.25-30 with SL around $29 for TP of $25.90.