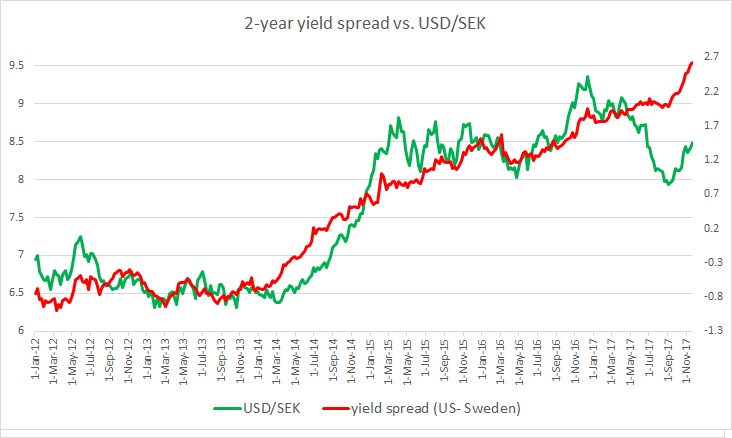

The chart above shows, how the relationship between USD/SEK and 2-year yield spread has unfolded since 2012.

- The Sveriges Riksbank (SRB) began reducing interest rates (repo rates) in the aftermath of the ‘Great Recession’ of 2008/09. The interest rates declined steadily from 475 basis points in 2008 to just 25 basis points in 2009.

- The rate was increased to 200 basis points in 2011 as the impact of the ‘Great Recession’ was less severe.

- However, the interest rates were reduced again in the aftermath of Eurozone debt crisis. Since the end 2011, SRB reduced rates from 200 basis points to zero in 2014 and was further lowered to -50 basis points in 2016 and it remained at the level.

- In addition to that, SRB introduced asset purchase program.

- It can be seen from the chart as while SRB started reducing rates again between 2011 and 2015 and maintained dovish tone, and the US Federal reserve indicated, and began to wind up its asset purchases, the 2-year yield spread widened in favor of the dollar by more than 200 basis points and the exchange rate declined from 6.4 per dollar to 8.6 per dollar.

- However, since the beginning of this year, there have been speculations in the market that the SRB would soon follow other central banks in the region, namely the Czech National Bank (CNB) that increased interest rates by 20 basis points in August this year. The speculation is being fuelled by higher inflation that reached a five-year high of 2.2 percent in August.

- In our review in August, we noted strong divergence as the yield spread widened by almost 9 basis points in favor of the dollar, while Swedish Krona has strengthened by almost 1000 pips against USD. We noted that such divergence is not sustainable in the medium term; hence expected the spread to narrow against the dollar and or the exchange rate to move lower in favor of the dollar. Thus we expected hawkish commentaries from SRB, in absence of which the exchange rate could decline favoring the dollar. The spread was then at 197 basis points and the exchange rate is at 8.1 per dollar.

- In our review in early October, we noted that the divergence has further widened. The yield spread has widened by 19 basis points in favor of the dollar, while the SEK has strengthened by 30 pips. And in our review on 31st October, we noted that the exchange rate has started responding to yield spread as it widened by almost 17 basis points to 233 basis points and the USD/SEK exchange rate weakened from 8.11 per dollar to 8.36 per dollar, thus reducing the divergence.

Since that review, the spread has further widened by 29 bps to 262 bps, while the Swedish Krona weakened by 130 pips to 8.487 per dollar.

So far SRB has resisted calls for a hike but a change in policy is due or we can expect a major correction in the exchange rate.

With central banks changing their monetary policy outlooks, we highly recommend regular following of the yield spread.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022