The decline in the dollar that began back in February 2002, after the Dot-com bubble burst in the United States, came to an end in 2008, with the great recession. Though Real Broad-based trade-weighted U.S. Dollar index made a further low in 2011. Since emerging market currencies played a crucial role in that particular drop and the Reserve Bank of Switzerland imposed a floor on EUR/CHF exchange rate, we would use July 2008 as the reference point for our comparison.

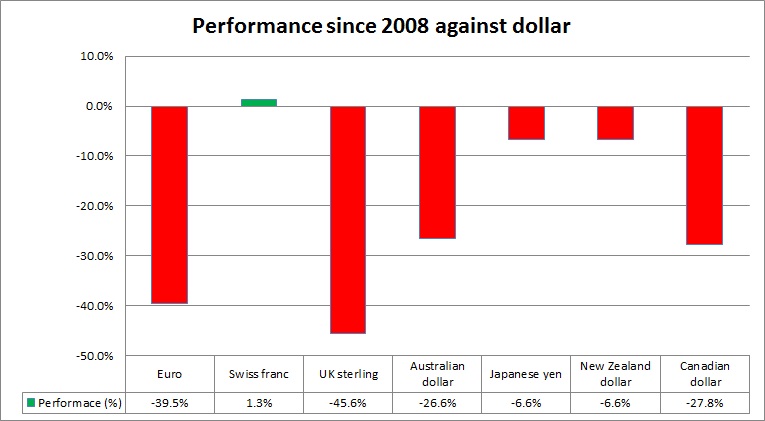

This simple performance comparison since 2008, shown above clearly depicts that Swiss Franc remains the most overvalued among the dollar’s most active trading partners. While the pound declined more than 45 percent and the euro declined almost 40 percent against the dollar since 2008, the Swiss franc has actually gained 1.3 percent; making is the most outstanding performer.

The franc benefited from a relentless inflow of money around the world and especially from the Eurozone, despite a clear divergence in yield and central bank policies. However, since 2012, the secrecy reputations of the Swiss banks were severely hurt as the US pursued a crackdown on tax evasion. With other key countries joining in the battle, the flows of money likely to dry or reverse course. The US president-elect Donald Trump has promised to announce a one-time repatriation opportunity that would be taxed at a much lower rate. If such a scheme is announced, billions of dollars are likely to move out of the country to the US.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed