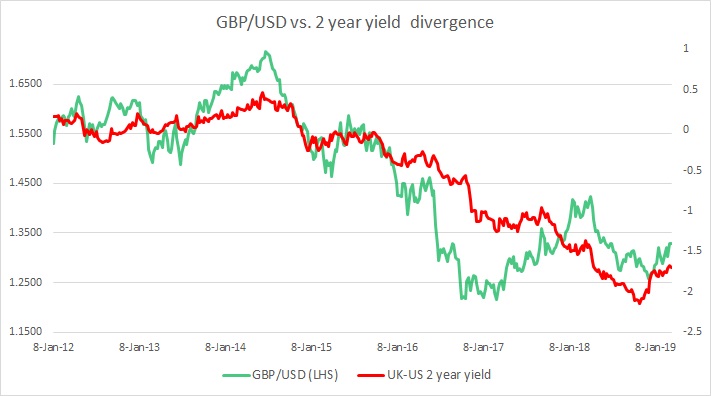

The chart above shows, how the relationship between GBP/USD and 2-year yield divergence has unfolded since 2012.

- The chart clearly shows the close relationship between the yield spread and the exchange rate. Since June 2014, the yield spread declined from 0.5 percent area to -2.15 percent area by November 2018, and GBP/USD declined from 1.71 to 1.25 area.

- In our December review, we noted that since the second week of November, the yield spread has reversed course, and rose from -2.15 percent to -1.9 percent, which suggested there might be a reversal in the exchange rate going ahead, should the spread continue its reversal.

- As expected, the exchange rate has reversed course.

- Although Brexit updates are causing major moves in GBP/USD, the chart clearly shows that yield spread remains a crucial underlying influencing factor.

- In March, the spread has further narrowed to -1.69 percent, while GBP/USD has strengthened to 1.326.