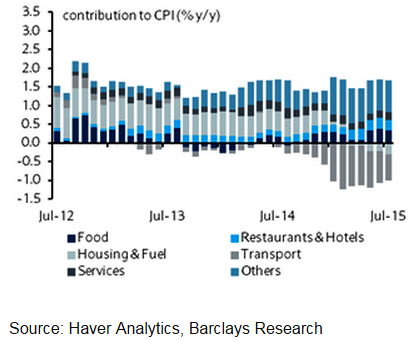

Delving deeper, the details show that the main drag on inflation was still largely driven by petrol prices, which subtracted 0.89pp on a contribution basis. Electricity was another distortion this month, with tariffs falling by 6.7% m/m, which deducted 0.14pp from the overall headline CPI.

Transport services and food prices were offsetting factors. Food prices added 0.33pp to the headline CPI, led by vegetables and meat on the back of the severe drought which has driven up food prices since May.

"Although the oil drag has moderated since February, the renewed downward pressure on oil prices is expected to deepen the price drag in the coming months", says Barclays.

The distortion from the drought to ease in the coming months, but the risk of a potential El Nino episode could keep food prices elevated. Prices for transport services also increased, rising by 6.5% m/m in July, which added 0.16pp on a contribution basis.

Prices for services related components were steady, with recreation, culture and education adding 0.14pp (Jun: 0.12; May: 0.11) and restaurants, hotels and others contributing another 0.39pp (Jun: 0.40; May: 0.41) to the July inflation.

The inflation remains benign and will gradually trend higher in H2. The softer-than-expected Q2 outturn has prompted us to lower our full-year GDP growth forecast by 40bp to 2.6% (BoK: 2.8%). With the potential benefit of further monetary easing diminishing, the next significant policy move is likely to be fiscal, not monetary.

Indeed, on 24 July the National Assembly passed a supplementary budget bill of KRW11.5trn. Assuming it is delivered by September, the actual growth impact (we estimate this at below 30bp) is only likely to be felt in the economy by Q4 and into 2016.

"There is still a risk of further easing in the remaining months of Q3, but only if incoming data deteriorates further. As such, the BoK is expected to stay on hold for the rest of the year, but with the focus of policy in engineering a weaker exchange rate, possibly by stockpiling more essential commodities like fuel", added Barclays.

Fuel prices to largely impact on Korean Inflation and BoK's rates

Tuesday, August 4, 2015 5:17 AM UTC

Editor's Picks

- Market Data

Most Popular

6

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022