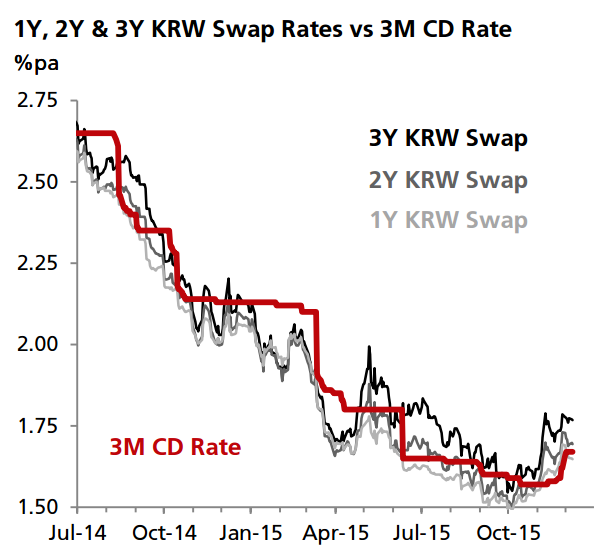

Frontend KRW swap rates are now trading above the 3M CD rate (which serves as the floating leg fixing for KRW swaps). This marks a change from 3Q when the market was speculating on further easing by the Bank of Korea (BoK). However, increases in KRW market rates are likely to be modest in the coming quarters. The pace of Fed hikes and the state of the Korean economy are critical to gauge the trajectory of KRW rates.

While KRW swap rates appear to have decoupled from USD swap rates (on the back of a slowing domestic economy and improving external balances) in the recent two years, price action in the past few weeks point to some wariness as the Fed prepares to normalize policy. Notably, the spike in KRW swap rates occurred only after the Fed reaffirmed rate hike intentions in late October. Meanwhile, the Korean economy is running on two speeds. Domestically, there have been clear signs of revival even as external demand remains lackluster. Against the backdrop, the KRW swap curve is likely to stay flattish before steepening when price pressures become more apparent.

Frontend KRW swap rates no longer pricing in further easing

Tuesday, December 8, 2015 3:06 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022