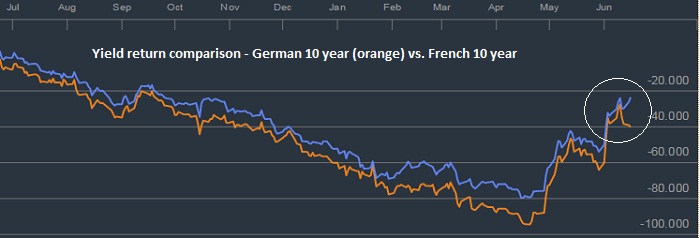

As legendary bond investor suggested historic opportunity to go short in German bund, we have suggested selling French counterpart and to go long in German French spread.

After months of lagging, the expected trade might have begun unfolding.

- German economy remains much stronger compared to France and remains in better shape to manage its debt and deficit. Moreover ongoing Greek crisis is likely to pour money into German safe haven bunds, in spite of the country's large exposure to Greece.

The gap in yields between French and German 10-year bonds has almost doubled in the last three trading days, after months of stability. These two, despite recent selloff has been moving in tandem so far.

The spread stands at 0.53 percentage points, up by 0.2 percentage points in the last three trading days. The gap was just 0.17% in January.

Even at this level, the Spread still looks attractive to enter betting that it will widen further, however this might be a longer term trade.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?