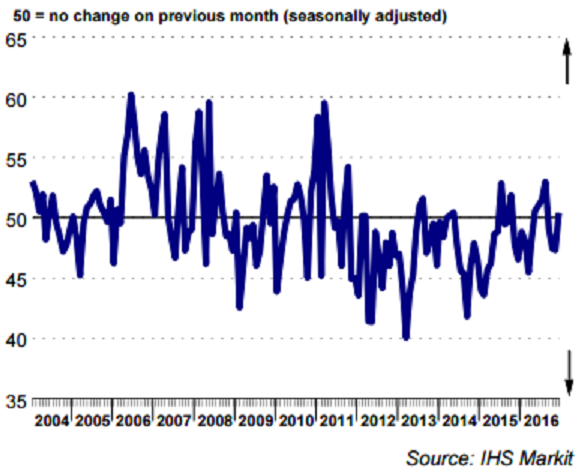

Retail sales in France increased for the first time since August last year, with the headline retail Purchasing Managers’ Index (PMI) marginally crossing the 50-point no-change mark during the month of December.

The seasonally adjusted headline Retail PMI rose to 50.4 in December, up from 47.3 in November, signalling a fractional rise in like-for-like sales. Anecdotal evidence suggested greater footfall numbers was the principal factor behind the uptick.

Nevertheless, sales remained down on an annual basis in December. Moreover, the latest year-on-year drop accelerated from the preceding month and remained marked overall. Actual sales continued to fall short of retailers’ previously set plans during December. Furthermore, the extent of the latest shortfall was greater than in the previous month.

Despite this, retailers remained optimistic that sales would exceed expectations next month. That said, the degree of positive sentiment was the lowest since July. Retail companies in France reported a rise in gross margins for the first time since January 2008 during December.

French retailers noted a further rise in whole sale costs in December. Moreover, the rate of increase was the sharpest in 11 months. In spite of a positive sales trend, firms continued to reduce their purchasing activity during December. The rate of decline accelerated from the preceding month, but was slight overall.

"The French retail sector finished the year on a positive note in December, with the first rise in like-for-like sales since August. That said, the rate of growth was fractional and sales were once again down on an annual basis. Nevertheless, increasing sales volumes and success in gaining new customers contributed to a widening of gross margins for the first time since January 2008," said Alex Gill, Economist, IHS, Markit.

Meanwhile, EUR/USD traded at 1.05, up 0.19 percent, while at 9:00GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at -46.06 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility