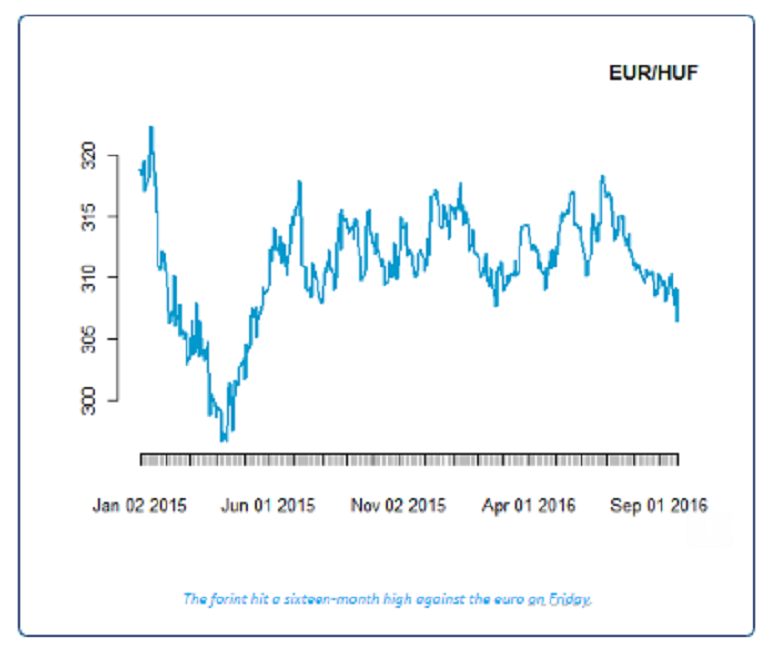

The Hungarian forint hit a fresh 16-month high on Friday, against the euro, following improved economic outlook rating by the Standard & Poor amid further support from the Federal Reserve’s decision to keep the key interest rate unchanged.

Regardless of recent gains, the room for further significant appreciation of the forint and the zloty in the weeks ahead appears limited. Minutes from the last meeting of the National Bank of Poland, released Thursday, mentioned the running debate about a possible rate cut. According to the minutes, certain Council members suggested that the interest rate cut could be justified already in the following few quarters.

However, for the time being, the call for a rate cut has been weak (identical quote could be found in the previous minutes, too) and therefore keep our outlook remains unchanged for stable rates in the near term. On the other hand, comments like this can put a cap on zloty´s exchange rate. Technically, the next support levels have been seen at EUR/PLN 4.26 and 4.23 (2016 high), KBC reported.

A similar scenario holds also for Hungary; further gains of the forint would likely spur central bankers to consider additional rate cuts, which are, in fact, to some extent already anticipated.

Meanwhile, at 17:05GMT, EUR/HUF fell 0.15 percent to 305.62, while it fell 0.23 percent to 272.48 against the greenback.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination