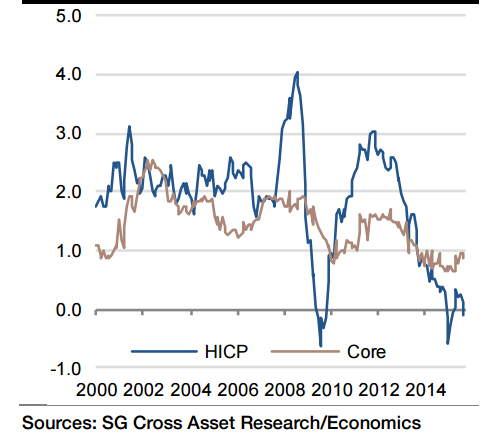

Euro area HICP inflation is expected to recover from -0.1% yoy in September to 0.0% in October. The expected recovery is likely to come from a noticeable improvement in energy prices (gasoline) alongside a positive contribution from steady food price inflation. The core print is expected to remain stable at 0.9% yoy. Among the core components, higher inflation is expected in nonenergy industrial goods (up from 0.3% yoy to 0.4% yoy) as well as a minor increase in services price inflation (from 1.2% yoy to 1.3%).

"We expect euro area HICP inflation to average 0.1% in 2015 and 1.0% in 2016, while the core metric should average 0.8% in 2015 and 1.2% in 2016", says Societe Generale.

Flash October Euro area HICP inflation set to print flat at 0.0% yoy

Tuesday, October 27, 2015 8:48 PM UTC

Editor's Picks

- Market Data

Most Popular

7

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed