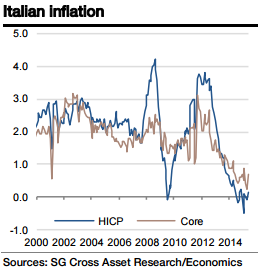

Energy prices to be the main driver behind higher Italian consumer prices as the other metrics should remain broadly stable across the board.

Italian HICP inflation in May rose more than we expected due to a more prominent rebound in energy prices, with the energy component rising, and a sharp jump in prices paid for services, with the relevant component rising.

"Italian HICP inflation is set to print at 0.3% yoy in June, one tick higher than in May", expects Societe Generale.

The food component remained stable while the non-energy industrial goods component rose. With goods and services both marching forward, the core component was up.

"Looking ahead, Italian HICP inflation is expected to average 0.6% in 2015 and 1.5% yoy in 2016. The core component should average 1.1% in 2015 and 1.3% in 2016", added Societe Generale.

Flash June Italian HICP consumer prices to rise by one tick

Tuesday, June 30, 2015 5:33 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022