The dramatic fall in India's headline CPI and current account deficit over the last year, alongside the government's commitment to economic reform, leaves the INR better insulated than most EM currencies to a Fed hike later this year.

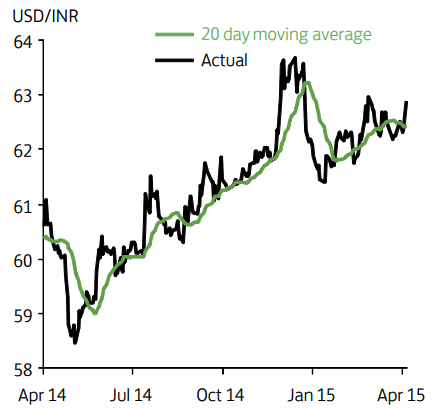

"A forthcoming firming in Indian inflation, RBI policy easing and Fed policy tightening shouldkeep USD/INR confined to the 60-64 range over the next six months", notes Lloyds Bank in a report on Tuesday.

However, it is not completely immune. Lower inflation and the government's reform agenda will likely pressure the RBI to cut interest rates by a further 50 bps this year, even though CPI should firms alongside higher crude oil prices in H2.

Meanwhile, a sustained break in USD/INR below 60 would likely be met by central bank intervention to weaken the currency; similar to what was witnessed in May-June last year.

USD/INR year-end target unaltered at 61.50, says Lloyds Bank.

Firming inflation, RBI easing to keep INR in 60-64 range short-term

Tuesday, April 21, 2015 5:15 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX