Recent financial market turmoil, which wiped out more than $15 trillion from global stock markets is leading to bone dry in IPO market. Private equities, angel investors are shelving their plans for IPOs as current market turmoil may not fetch a good price.

According to a survey by Ernst and Young, Private equity managers feel that number of IPOs would be significantly less in 2016 but still a public offering stands as best option to exit rather than selling portfolio privately.

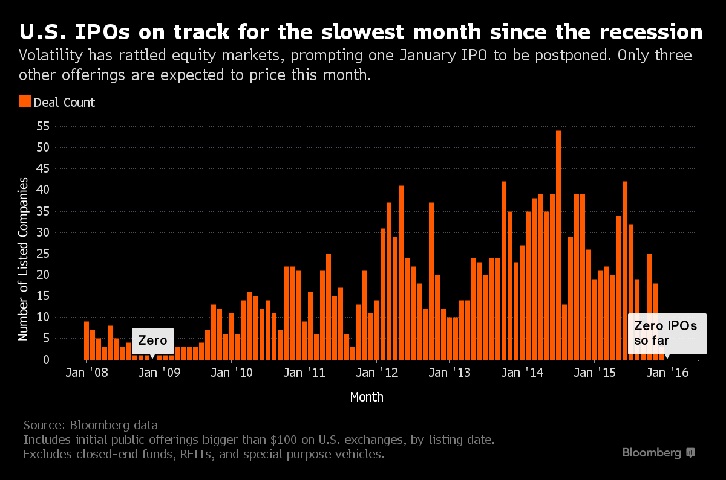

However, market turmoil is leading to a bone dry scenario for IPO market. We are almost at the end of first month and number of IPOs launched is zero, which is for the first time since December 2008, according to a report by Bloomberg. According to Bloomberg data, number of IPOs launched in 2015 January have been 19 and in 2014, number of IPOs launched in January were 54. So far there has been only one IPO, planned for January, which got delayed.

While it surely doesn't point to further drop in stocks but do point to grim mood surrounding market.

After Friday's rise and last week's positive close, S&P 500 is back in red. S&P 500 is currently trading at 1873, down -0.3% for the day so far.

Chart courtesy Bloomberg.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022