Over the past two weeks, the rates market has significantly repriced rate-hike expectations from no lift-off this year to a high probability of a September hike. This has consequently put renewed upward pressure on the dollar and brought back to the fore the question that was on everyone's mind not too long ago: can the Fed hike rates when the rest of the world is easing? As earlier, the answer remains yes. Admittedly, the FOMC did get spooked by the dollar's strength earlier this year, but this was driven by the soft data and uncertainty about what caused the weakness. Today, the context is very different. The economy is rebounding from the winter soft patch, albeit not as sharply as initially expected. Importantly, the labor market never skipped a beat and core inflation has held up reasonably well despite the external pressures. This should give the Fed more comfort to hike, even in the face of a slightly stronger dollar.

Of course, a more significant appreciation in the USD - say, another 10% or more - could dampen the Fed's enthusiasm for policy normalization. However, this is unlikely. As noted earlier, the recent rally was driven by a modest repricing of lift-off expectations to September; for it to continue, the market would have to start pricing two hikes this year, or four or more hikes next year. Any such attempt would be quickly squashed by Fed officials.

Societe Generale notes:

Our central scenario is that the FOMC hikes in September, but keeps the dots unchanged, effectively signalling that the second hike is unlikely until early 2016. This should be enough to dampen the pressure on the dollar and to prevent a tightening in broader financial conditions. In other words, the Fed's gradualism should translate to a gradual and controlled dollar appreciation.

Looking to next year, the market is only pricing three hikes and the risk in our view is for more. Yet, the trigger for repricing the pace of increases can only come from wages and inflation. Although we are bullish on wage growth, we do not expect any fireworks ahead of the September meeting. The bottom line is that we expect the dollar to continue drifting higher, but in a somewhat controlled fashion. Our FX forecasts imply a roughly 5% appreciation over the next three quarters which is modest compared to the 15% rally over the past 12 months.

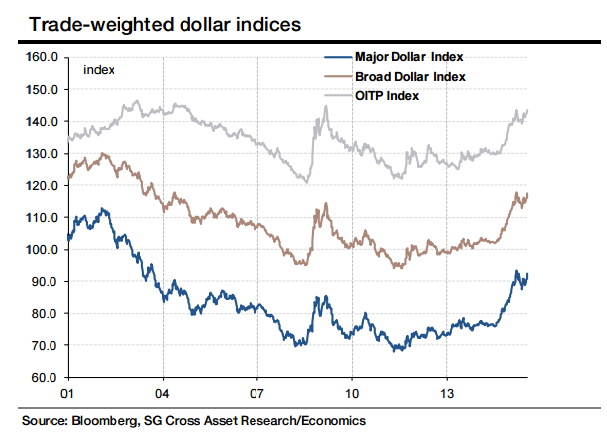

As for the growth outlook, we believe that much of the dollar-related drag is behind us. Standard macro models suggest that a 15% appreciation in the trade-weighted dollar index should shave roughly 0.5% from growth in the first year, another 0.5% in the second year and peak after roughly 10 quarters. Having lost 1% to net trade in Q4 and nearly 2% in Q1, we believe that much of the impact was front-loaded. A bulk of the adjustment occurred in the commodity space (more energy imports, less food exports), where both price and quantity responses are fairly quick.

The manufacturing sector is still adjusting to the strong dollar, but on balance, the drag should diminish going forward. A further 5% appreciation, assuming that is it gradual and occurs in the context of improving domestic demand, should have a relatively small impact on growth. Inflation implications from a stronger dollar are also limited in our view. Our models suggest that a 10% dollar appreciation shaves only 0.1% from core inflation in the first year.

Fed’s “gradualism” implies gradual dollar appreciation

Thursday, July 23, 2015 8:54 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed