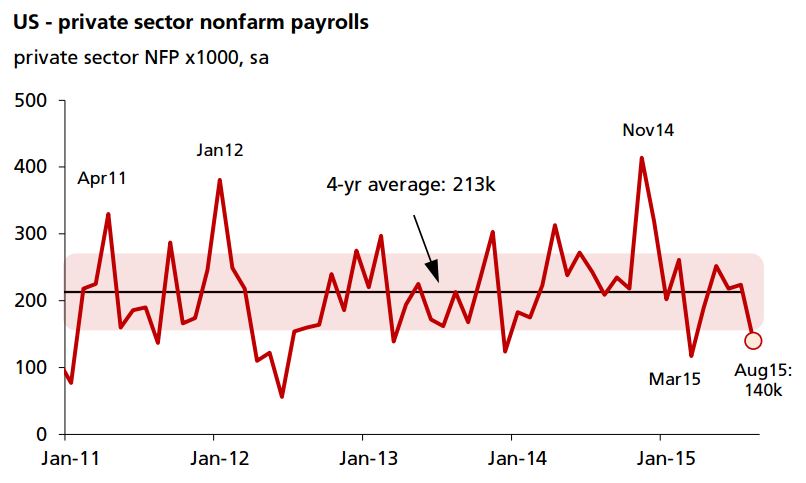

Private sector payrolls are back at 140k, core PCE inflation has dropped to 1.2% YoY, growth in the first two quarters of the year has averaged 2.1% (QoQ, saar), core capex expenditures haven't grown one iota in 3.5 years. And the most recent Fed rhetoric, including from Lockhart last Friday is: it's time to raise rates?

The reason used to be because job growth was picking up and that would drive inflation higher. But job growth was never really picking up, it was just bouncing around. And lately it's bounced pretty hard the wrong way.

"We're not too concerned about it - the 140k in August is probably just normal volatility. But it underscores the fact that all the Fed talk last year about 'better job growth' wasn't based on the data, it was just talk," DBS Bank says.

The reason to hike today is still because 'inflation is going to go up' - it's just that the 'better jobs growth' part is left out of the equation. Or knocked down by a first difference. Steady growth is good enough, it is said. Inflation is still going to go up. Yes, slack is being mopped up. And yes, someday inflation will go back up. But when? 2016? 2018? The Fed's favourite inflation gauge is down to 1.2% and it's falling - been falling for 3.5 years.

The bottom line is the Fed wants to hike because the Fed wants to hike according to DBS Bank.

Markets don't want to fight the Fed but they don't think it will get very far. Ten-year Treasury yields are back at 2.12% and Fed fund futures markets expect only 62 basis points of hikes between now and end-2016. If the Fed gives us one hike this year, as it seems to swear it will, that leaves a hike-and-a-half for all of 2016.

"Wouldn't it be better to put that hike-and-a-half back in your pocket and hope for steady inflation and better jobs growth instead?," notes DBS Bank.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022