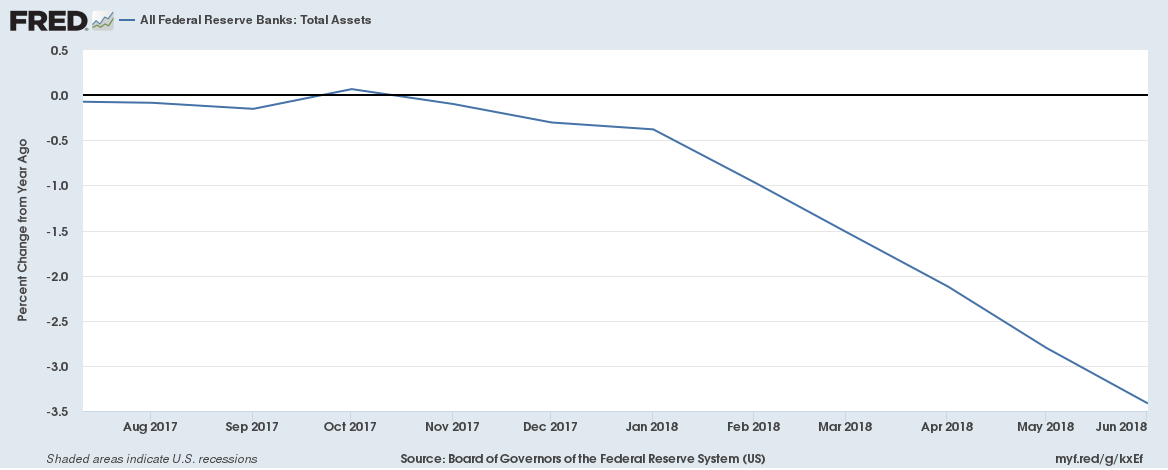

The Fed’s balance sheet reduction, which is one of the key reasons for dollar liquidity drain from the financial systems is gathering pace and soon it would hit its peak of $50 billion per month. The balance sheet reduction began last year in October with $10 billion per month and as of this month, it has gradually increased to $40 billion per month and in October the pace would hit $50 billion per month, which is the announced ceiling rate of reduction by the U.S. Federal Reserve.

The chart shows that the size of the balance sheet is down 3.42 percent from a year ago but with balance sheet reduction gathering pace, we expect that number to reach as high as 25 percent, just like it did when the Federal Reserve was purchasing assets at the pace of $600 billion per annum.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action