With bonds and stocks in trouble Real Estate might be the asset class that would provide higher return across Europe. However, real estate investments require large sum of capital and is illiquid, not suitable for all investors.

Report by financial times' shows that global investors are pouring money to European real estate market.

- Both residential and commercial property would get boosted as recovery gathers pace in Euro zone. As of now, lot of people remain jobless in Euro zone, with average unemployment is hovering close to 11.3%.

- Growth trend shows that jobs are being added at record pace for some economy like Spain, Italy, and Ireland. Moreover growth would also let businesses to expand looking for new commercial places.

ECB provides helping hand -

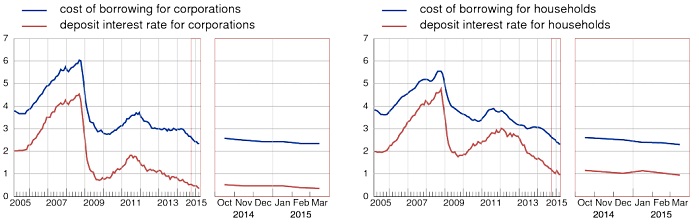

- Interest rate statistics from European Central Bank shows that credit conditions have eased considerably since the introduction of asset purchase program. Loans to SMEs has fallen to record low in Italy (4.1%) and Spain (3.4%). Loan growth to businesses has also returned to positive territory. Average borrowing cost to corporates have fallen to record low of 2.34%

- Households are in better position too. Borrowing cost of new house purchase has fallen to record low of 2.3%.

How are prices per Sq. ft.?

- With € 100 million one can purchase office space of size 21593 Sq.ft. in London, 42072 Sq.ft. in Paris, 81307 Sq.ft. in Frankfurt, while periphery remains much cheaper as with Madrid 124,674 Sq.ft. and Brussels 166,073 Sq.ft.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?