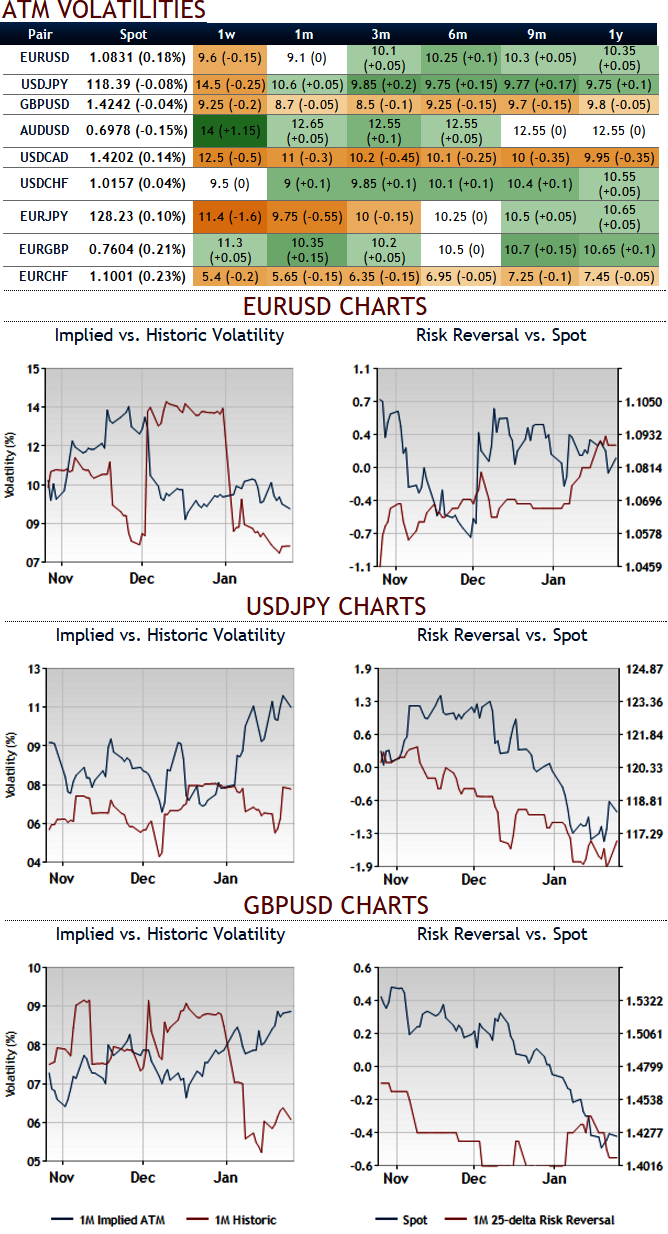

Spot FX vols in almost all major pairs except GBPUSD and Swiss franc crosses have scaled up almost a maximum point over the past two weeks (basis VXY) as worldwide equity avenues were churned out by Chinese meltdown. While, the macro debate has already turned towards the potential recessionary impact of EM stress before resilient DM economies.

The instant discounting of future and rarer rate hikes and/or additional policy easing by DM yield curves is indicating a macro-economy that is far from impolite healthiness, but then optimism of short-term relief springs perpetual arbitrating by the rally in risky avenues after dovish ECB commentary in last week.

A short squeeze is never out of the question in markets that have endured terrific thrashing in a small span of time, especially with prospects of additional monetary lift from the BoJ next week. But it would be brave to bet on incremental policy stimulus with increasingly diminishing returns arresting the retaliation of a credit cycle that has been more than a decade in the making. The strategic view on vol remains resolutely bullish.

Even at a micro level, we believe it is tougher to deter ourselves away from a long-held bullish gamma bias that at its core rests on the broken plumbing of the FX market and the wild price swings it breeds -illiquidity in currencies as measured by widening bid-offer spreads and the "gappiness" of price action is at or near prior crisis highs even as implied vol levels outside of EUR/- and JPY/high-beta crosses remain relatively tame around long-run averages.

The multi-sigma swings in short dated forward points in CNH and HKD over the past two weeks is also a reminder that policy-induced volatility has not departed the scene, and it is in anticipation of a recurrence of policy drama in Brazil that we bought 3M USD/BRL straddles earlier in the week.

In general, we don't intend for any extensive alterations to our FX stances or trade recommendations in anticipation of any impending lull in vol. The only factor we discount for a hypothetically narrow and short-lived window of calm is to enter into a couple of short-dated one-touch calendar spreads in JPY and CAD that can collect theta with defined premium risk.

FX Vols spiking as EM contagion to DM, worsening illiquidity preserve gamma bullishness

Wednesday, January 27, 2016 1:22 PM UTC

Editor's Picks

- Market Data

Most Popular