The minutes of last FOMC meeting will be published today at 7 pm GMT. Dollar so far has not moved much for the day as market awaits the release. Several notes-

- Evaluating the scenarios it seems, for today's reaction, market will be looking at specific hawkish presence like the absence of "patience" word or frequency of dovish words in the minutes.

- Another area of interest will be Fed's comments and views on two particular developments, inflation expectation & easing by other central banks.

Dollar has so far rode well on hawkish FOMC and this month so far it has not been able to continue on its consecutive 7 monthly rise.

- Dollar could falter if FOMC remains neutral and does not remove such wordings. We view this is to be very much likely as FOMC clearly mentioned no raise till April. Hawkish FOMC will encourage the bulls further.

- We will look out for the rate outlook by the FOMC participants, which last time saw a reduction of 25 basis points. Currently there exists big disparity of rate forecast between the market & FOMC participants.

Despite any mild dovish or neutral comment we expect the dollar to do well in the medium term. Treasuries might rally if rate forecast drops.

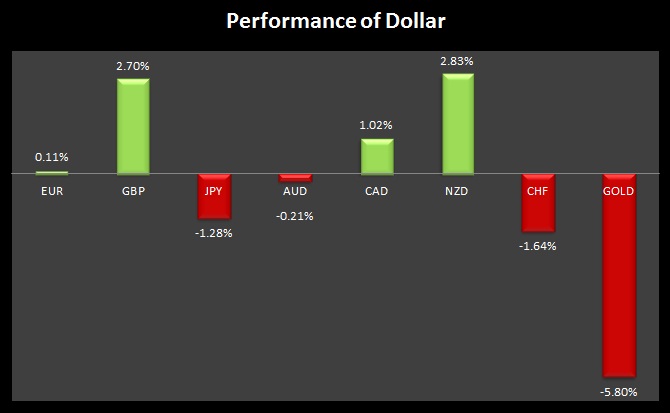

A table and chart is attached showing Dollar's performance against major counterparts in February so far -

|

EUR |

0.11% |

|

GBP |

2.70% |

|

JPY |

-1.28% |

|

AUD |

-0.21% |

|

CAD |

1.02% |

|

NZD |

2.83% |

|

CHF |

-1.64% |

|

GOLD |

-5.80% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings