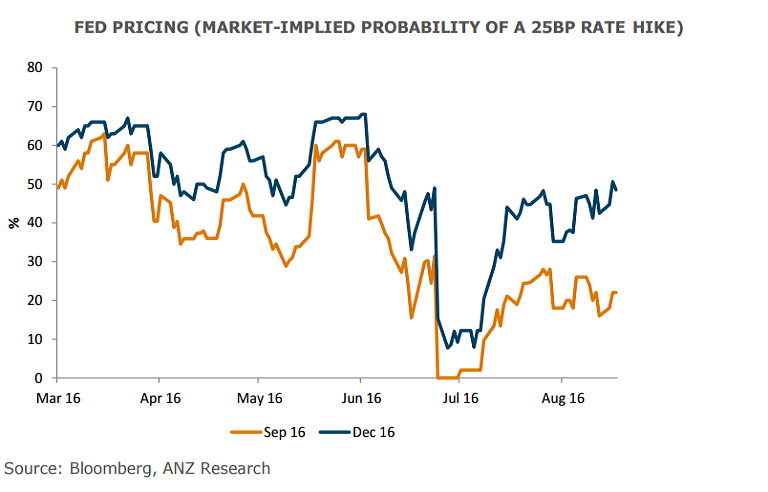

US Federal Open Market Committee minutes released overnight highlight that officials are divided, with no clear indication of when the central bank will hike next. The minutes showed that members were generally upbeat about the economic outlook and labor market, but several said a slowdown in the future pace of hiring would argue against a near-term hike. The market currently is 22 percent priced for a move in September and just under 50 percent for December.

Fed officials have recently reminded the market not to be too complacent and that the bias at the Fed is still to raise interest rates. NY Fed president Dudley’s said on Tuesday that markets are too complacent about rate hike risks. Dudley said he expected stronger growth in the US in H2 than in H1 and further improvement in the labour market. That sentiment was echoed by FRB Atlanta President Lockhart.

“Hawks balanced with doves and the Fed in wait-and-see mode,” said Kit Juckes, strategist at Societe Generale. “I don’t think this tells us much about the September meeting, which is, as ever, data- and market-dependant, but it does tell us that the most we’ll get is a very slow and cautious tightening path.”

The key to when the central bank moves remains the underlying data flow. Recent data suggest growth probably accelerated in Q3. Headline Q2 GDP growth (+1.2 percent saar) was disappointing, but underlying activity was still positive and will remain supported by stimulatory financial conditions. Residential investment, which was a significant drag on Q2 GDP appears to be recovering. Recent solid gains in employment suggest underlying momentum is better than the headline GDP.

That said, despite signs of a pickup in wage growth, headline inflation remains below target. July CPI fell to 0.8 percent y/y from 1.0 percent in June and the PCE is hovering at 0.9 percent y/y. Core inflation is closer to the Fed’s 2 percent target. University of Michigan 5-10yr inflation expectation remains low but stable at 2.6 in July.

"An ongoing tightening in the labour market and relatively stable inflation expectations point to a gradual return in headline (PCE) inflation towards the target (2 percent) over the near to medium term," said ANZ in a report to its clients.

The FOMC's next meet (21-22 Sept) will be accompanied by a press conference from Janet Yellen and the updated Summary of Economic projections (including the fed fund rate). Hurdle probably remains a little high for September rate move. Another round of monthly data (employment and CPI) will be available for scrutiny. However, one month of data may not be sufficient to provide the confidence the Fed needs.

The dollar saw choppy trading, shorter-term Treasury prices turned higher and stocks nudged into positive territory after the release of minutes on Wednesday. DXY extending dips on the day, down 0.36 percent at 94.39 at 11:30 GMT. USD/JPY was at 100.19 while EUR/USD was at 1.1327.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data