D-day is finally here, last FOMC meeting of the year, decision today, in which FED is widely expected to increase rates from zero bound by a hike of 25 basis points, almost a decade after last one. The decision would be announced at 19:00 GMT, followed by a press conference at 19:30 GMT by FED Chair Janet Yellen.

Market is pricing 83% probability that rates will rise in today's meeting as of now.

In this, FED liftoff series, we have been discussing over the impact, implications and various possibilities of a first rate hike from FED in about a decade. Last time FED hiked rates was back in 2006.

In previous articles we discussed why rate hike from FED is still crucial, despite it being well priced in, beginning of a mega unwinding of monetary stimulus, our take on US rates via term premia, impact on equities and various expectations over FED hike path.

In this piece, we take on the Dollar.

There are three Dollars -

According to our baseline analysis, federal funds rate hike by US Federal Reserve will have direct impact on two fronts - global interest rates, which we covered in previous posts and the other one is Dollar. Discussing on the impact of Dollar, we found in our analysis, there are in fact, not just one Dollar to consider (of course...literally there is only one USD) but there are three Dollars in the market and each might experience different impact post hike.

- Dollar against developed market currencies (D-Dollar)

- Dollar against commodity currencies (C-Dollar)

- Dollar against emerging market currencies (E-Dollar)

For further reference we would call them in short - D-Dollar, C-Dollar and E-Dollar.

Lessons from history and D-Dollar

Since 1972 Bretton Woods agreement and Dollar got floated, there has been three most significant Dollar rally.

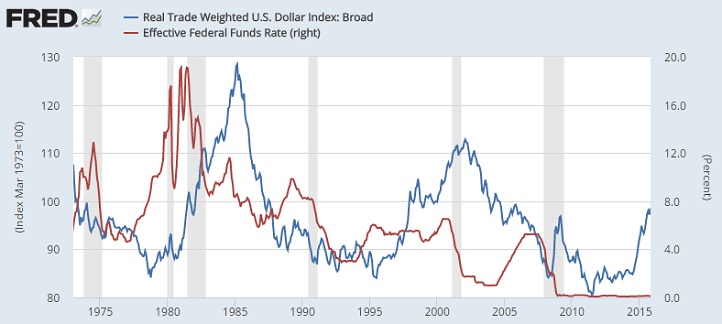

First one started back from October 1978 and lasted till February 1985, in which real trade weighted US Dollar index (as shown by the figure) rose from 84 to close to 130. This rally was fuelled during the times of Ronal Reagan, by tight monetary policy and loose fiscal policy. Effective Federal funds rate from 4.75% in 1977 went to as high as 19% by 1981. It wasn't until late that year, it slowly started coming down. However, Dollar has continued its rise, even as rates drop and it took Plaza accord, (dollar selling globally) to tame the Dollar, which kept falling for the next decade.

Next, rally was back in Bill Clinton era, fuelled by shift from beggar thy neighbor or Dollar as a trade weapon policy by Robert Rubin and rising inflow due to tech hype, which finally got burst in 2000/01. Dollar rose from 84 to as high as 110 during this era, which finally ended with US Federal Reserve reducing rates post-tech-bubble burst.

And now we are experiencing third major Dollar rise. Dollar had start rising since 2011, however the rise only got pace back in mid-2014, from where it is up more than 20%. This time it is being fuelled by policy divergence.

From historical context, we can conclude that, while FED interest rate movement do have profound effect on Dollar, however its rise and fall is not a certainty, especially in the medium to long term. For example, FED hike rates from 2001 to 2006 from 1% to as high as 5.25%, however that failed to impact, Dollar's decline any meaningful way, However, policy then was globally wasn't as diverging as it is now.

However, it is important to note, when FED hike or reduction of rates do coincide with the direction of the Dollar cycle (hike when cycle rising..reduction when cycle declining), it fuels the trend.

What to expect from D-Dollar?

Since this Dollar rally is fueled by divergence, rather than rates, it would need the fuel of divergence to move ahead. As of now, it seems, divergence might take a dent, since European Central Banks (ECB), didn't boost the balance sheet much. However in the medium to long term context it seems, policy divergence (which in reality is continuing as we speak), will continue for the next two years at least. ECB is committed till March, 2017. Bank of Japan is committed to unlimited QE, till inflation.

Trading perspective -

In the short run, Dollar strength might get dented over profit booking on the divergence so far, since FED is likely to be hawkish in action but dovish in its message. However, the D-Dollar is likely to gain back the driving seat, as economy diverge and future actions from the FED (especially in balance sheet front) becomes visible, possibly after initial four five months of next year.

Impact on other two, we would discuss in our subsequent articles.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022