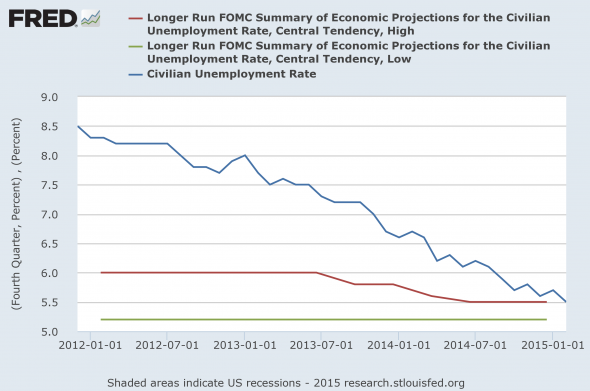

Federal Reserve has a dual mandate; price stability and maximum employment. The chart is prepared in FRED dashboard of St. Louis FED.

How each mandate stands?

Price stability -

- Probability of deflation has diminished over the years through FED action.

- Inflation remained below FED's target of 2% since the crisis.

Maximum employment -

- Unemployment rate has dropped to 5.5% much faster than economists and FED were expecting.

- It currently stands at the upper range of the central tendency of longer run FED forecast.

Recent FED speakers -

- Loretta J. Mester - "Rate hike needed soon. Will not support a less than 25 basis points hike."

- Richard Fisher - " FED need to rate hike or lose credibility"

- James Bullard - "Rate hike is overdue"

Dollar -

- Excessive strength of dollar is sure to be discussed over the FED meeting and would pose a challenge for FOMC.

- Stronger dollar pose challenge for inflation as well.

Probability -

- FED to go with the first rate hike around June this year.

- Move to a neutral stance thereafter for much longer time than market is expecting.

- Shout the buck down, after the rate hike.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings