Eurozone’s purchasing managers’ index for manufacturing rose in October against expectations, reaching a new multi-year high of 58.6. Its service sector counterpart, in contrast, fell more than expected, by 0.9 points to 54.9. This can be interpreted as a sign that economic activity has peaked.

Today’s data should play into the hands of the ECB, which can present the forced tapering of the bond purchasing programme in 2018 as fundamentally justified. A robust upswing has become established in the eurozone. Neither the temporary slight decline in global demand nor the euro appreciation since May seem to dampen sentiment in the manufacturing sector, Commerzbank reported.

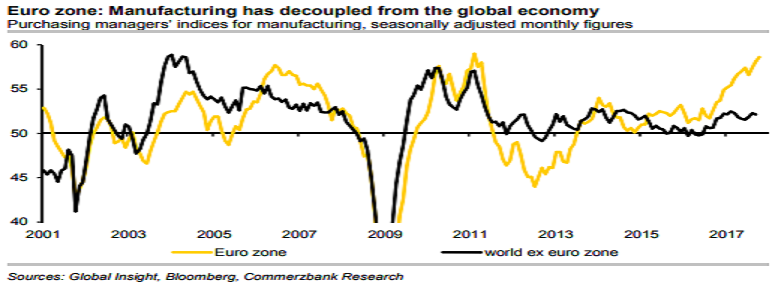

In October, the purchasing managers’ index (PMI) for this sector rose by 0.5 points to 58.6, not only printing a new multi-year high but also diverging even further from the global index for manufacturing (chart). The decoupling of the eurozone manufacturing sector from global economic activity shows that the upturn is mainly driven by domestic demand. The ECB’s zero interest rate policy makes the persistently high debt levels of consumers and businesses sustainable.

This debt is, therefore, no obstacle to higher consumption and investment expenditures. On the other hand, the decline in the PMI for the service sector, which was closely correlated with the change in GDP in the past, shows that growth has its limits even in the eurozone.

"We assume that in Q3 and Q4 real GDP will grow at a rate of 0.5 percent each, which would be slightly lower than in the preceding three quarters (0.6 percent on average)," the report said.

Meanwhile, the strong growth will enable the central bank to make the inevitable reduction of its bond purchases in 2018 seem fundamentally justified, as strong growth will also boost inflation over the medium-term.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom