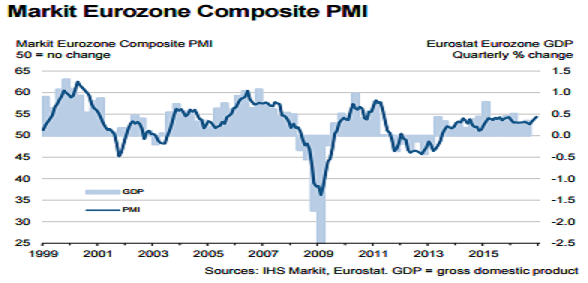

Output growth in the eurozone accelerated to a 67-month high to round off the best quarter of the year. However, price pressures continued to mount, with inflation of both input costs and output charges gathering pace.

At 54.4 in December, up from November’s 53.9, the final Markit Eurozone PMI Composite Output Index signalled a faster rate of expansion than the earlier flash estimate. Manufacturing led the growth acceleration, with production increasing at the quickest pace since April 2014. Service sector activity also rose solidly, with the rate of increase staying close to November’s 11-month high.

Economic expansions were signalled across the 'big-four' nations. The fastest growth was seen in Spain (6-month high) followed closely by Germany (5-month high). The pace of increase in France accelerated to a one-and-a-half year record, but remained below the euro area average. Italy was the only one among the largest nations to see slower growth.

Underpinning the stronger expansion of eurozone economic activity was an improved inflow of new business. Growth of incoming new orders was the fastest since December 2015 and among the quickest seen over the past five-and-a-half years.

Spain and Germany both registered solid jobs growth in December. France and Italy also saw employment increase, albeit marginally. Spain was the only one of the ‘big-four’ to see staffing levels rise at a faster pace than in November.

Input cost inflation surged to a five-and-a-half year record in December. This reflected a combination of higher fuel and oil prices alongside increased import costs due to the weaker euro exchange rate. Output charges rose for the second month running and at the steepest pace since July 2011. Increases in Germany and Spain offset further price discounting in France and Italy.

At 53.7, the final Markit Eurozone PMI Services Business Activity Index was down only slightly from November’s 11-month high of 53.8 and above the earlier flash estimate of 53.1. Business confidence† hit an 11-month peak and was among the highest levels achieved over the past five years.

"The concern is that domestic demand is likely to remain subdued over the course of 2017 as political uncertainty dominates, resulting in another year of disappointing growth across the region as a whole," said Chris Williamson, Chief Business Economist, IHS, Markit.

Meanwhile, EUR/USD traded at 1.04, up 0.33 percent; at 9:00GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at -39.38 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment