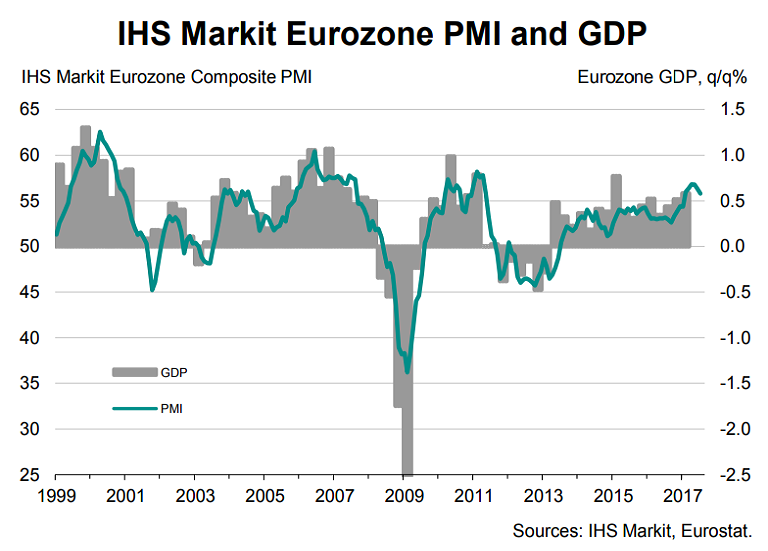

IHS Markit's euro zone Flash Composite Purchasing Managers' Index for July fell to 55.8 from 56.3 in the previous month. The reading was below median expectation in a Reuters poll for a modest dip to 56.2. Despite coming off recent highs, the composite PMI index was still comfortably above the 50 level that separates growth from contraction and suggested that Euro zone businesses started the second half of 2017 with solid growth.

The upturn was once again broad-based. Manufacturers continued to report stronger output growth than service providers, despite the rate of expansion easing to the weakest since January. The rate of job creation continued to run at one of the highest seen over the past decade. Forward-looking indicators such as new order inflows remain elevated, suggesting robust growth will continue into coming months.

"It still looks like a robust, broad-based sustainable upturn, it's just losing a bit of momentum and it's too early to get too worried about this. The PMI, if maintained, pointed to third quarter GDP growth of 0.6 percent," said Chris Williamson, chief business economist at IHS Markit.

Meanwhile, the European Central Bank’s announcement of not cutting interest rate any further might be construed as a baby step towards normalisation despite continuing stimulus spending through its trillion Euro bond buying activity. Years of ultra-easy policy may be bolstering growth, but the central bank is struggling to bring inflation to target range and will likely be in no rush to taper policy.

That said, the economic situation in the eurozone continues to improve and the risks are balanced. Following ECB President Mario Draghi’s speech at Sintra in late June, the markets saw a strong adjustment. The 10y Bund yield rose more than 30bp. The September meeting is still critical and markets will look for change in the wording of the forward guidance. The ECB is also set to presents new staff projections at its September meeting.

Patrick Jacq, Research Analyst at BNP Paribas suggests that the ECB will be more vocal in September as there was no significant change in ECB rhetoric at its final press conference on 20 July before the summer rest period.

EUR/USD has been on an uptrend since Jan 2017. The pair has risen almost 13 percent since the beginning of the year. Today, EUR/USD was down 0.11 percent, easing from fresh 11-month highs at 1.1684. The pair finds stiff resistance at weekly 200-SMA at 1.1794. Break above could see breakout of major channel top and test of 1.25 levels then likely.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals