The headline IHS Markit Eurozone PMI fell from a joint six-year high of 56.8 in May to a five-month low of 55.7 in June, according to the preliminary ‘flash’ estimate released earlier today. Data missed economists' forecasts for a reading of 56.6. Manufacturing PMI came in at 57.3, beating forecasts at 56.8, but services PMI stood at 54.7, below the 56.2 forecast.

The forward-looking components of the June survey fell. The new orders sub-index edged down from 55.9 to 55.7 in June, reflecting weaker new business growth in the services sector. The future output index also dropped, from 68.3 to a five-month low of 66.0. But they are both still at high levels and consistent with a decent pace of quarterly growth.

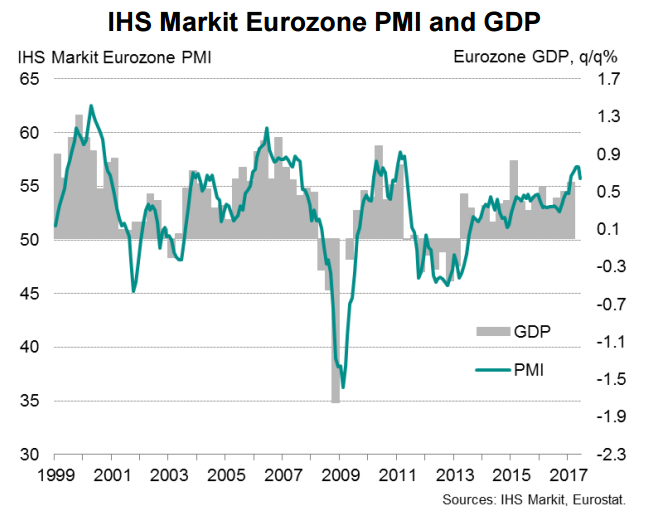

“Although the PMI data point to some loss of growth momentum in June, the latest reading needs to be looked at in the context of recent elevated levels. Despite the June dip, the average expansion in the second quarter has been the strongest for over six years and is historically consistent with GDP growth accelerating from 0.6% in the first quarter to 0.7%," said Chris Williamson, Chief Business Economist at IHS Markit.

According to data released by the European Commission on Thursday, consumer confidence across the eurozone hit its highest level since 2001. Eurozone flash consumer confidence index rose to -1.3 in June, from -3.3 in the previous month. Sentiment in the broader EU also climbed by 1.1 points to -2.2.

High consumer confidence is supportive of faster consumption growth. The upbeat data comes as unemployment in the eurozone has fallen to its lowest level since 2009. Data indeed is painting is rosy picture and 2017 looks like a strong year for eurozone growth.

EUR/USD was edged lower from session highs at 1.1187 after PMI data miss. The pair was trading at 1.1170 at around 1145 GMT. The pair has formed a bottom around 1.11394 levels. Intraday major resistance is around 1.11800 (89 EMA) on the 4 hour chart and any break above will take the pair till 1.12075 (100 MA)/1.1230/1.12950. On the lower side, any break below 1.1100 confirms minor weakness, a decline till 1.1050/1.1000 likely.

FxWirePro's Hourly EUR Spot Index was at -1.93249 (Neutral), while Hourly USD Spot Index was at -71.3511 (Slightly bearish) at 1145 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran