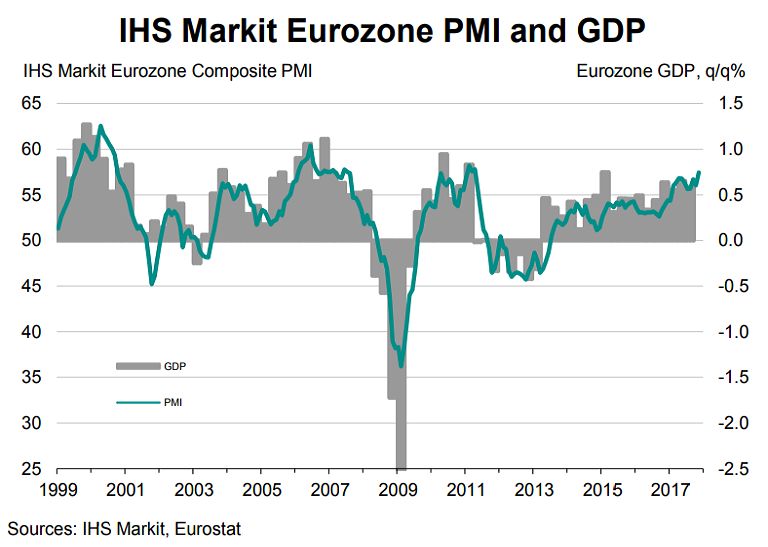

Flash Eurozone PMI indicators - output, demand, employment and inflation - hit multi-year highs in November suggesting the eurozone economy will see a strong end to 2017 and enter 2018 on a firm footing. Data released last week showed IHS Markit’s composite flash PMI for the euro zone jumped to 57.5 this month, its highest since April 2011 and beating forecasts for no change from a final October reading of 56.0.

PMI data serve as a precursor of private sector economic activity by tracking a selection of variables across the manufacturing, construction, retail and services sectors. The results of economic surveys from the euro area released over the past week have been universally upbeat suggests economic growth in the Euro-Zone continuing to accelerate with manufacturing leading the way.

According to a report from the European Commission, the Eurozone Consumer Confidence Index stands at 0.1 so far in November 2017 compared to -1.1 in October 2017. The index moved into positive territory for the first time in 16 years, also beating the market expectation of -0.8. Data signals significant economic growth momentum heading towards year-end.

“The message from the latest Eurozone PMI is clear: business is booming. Growth kicked higher in November to put the region on course for its best quarter since the start of 2011. The PMI is so far running at a level signalling a 0.8% increase in GDP in the final quarter of 2017, which would round-off the best year for a decade." said the IHS Markit press release.

Accelerating growth in the euro zone, alongside increasing price pressures, will be welcomed by policymakers at the ECB who last month took a step towards weaning the euro zone off loose money. “Data make it easy for the ECB to justify its forced reduction of the bond buying program in 2018,” said Christoph Weil at Commerzbank.

EUR/USD is retreating from 10-week highs at 1.1961 and is currently trading at 1.1885, down 0.10% on the day. The major finds strong support at 1.1877 (converged 5-DMA and cloud). Break below will see weakness, raising scope for test of 100-DMA at 1.1774. On the flipside, next major psychological resistance lies at 1.2000 and any break above will take the pair till 1.20900. Break above 1.2090 required for further bullishness.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand