Euro has been getting bashed against Yen since mid of last year, from June basically, after which weakness in China's economy and its currency got center stage and kept Yen well bid. European Central Bank has also fuelled expectations for further monetary easing that time, so no wonder Euro got bashed against Yen under such circumstance.

However, since ECB disappointed in December, expectations have somewhat changed. Moreover, Euro is acting like risk averse currency, not like Yen but to some extent. So while Dollar, Pound, Aussie, Kiwi, dropped sharply against Yen this year, Euro was able to hold on to its ground.

Moreover recent subside in risk aversion, also benefiting Euro, more than Yen.

We remain fundamentally positive on Euro, over the very long run as growth prospect is much better in Europe than in Japan.

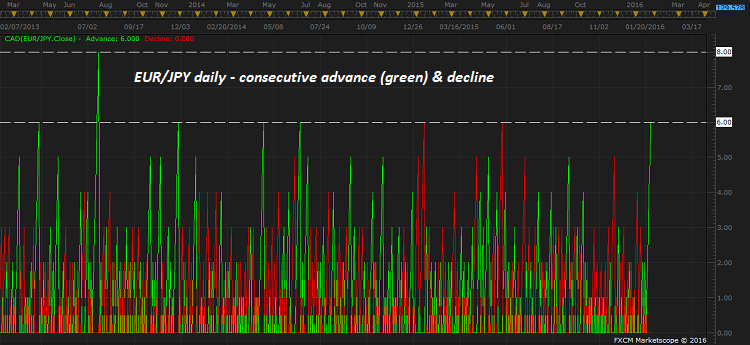

In the short run, however it is important to note that Euro rose against Yen for six consecutive days for the first time since June 2014.

So, with BOJ policy tomorrow, there could be some correction in that front, if BOJ stay put. Nevertheless, Even if the trend in the short run is down for EUR/JPY, we expect Euro to correct as high as 132 area against Yen. So tomorrow's correction could pose opportunity to buy the pair.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed