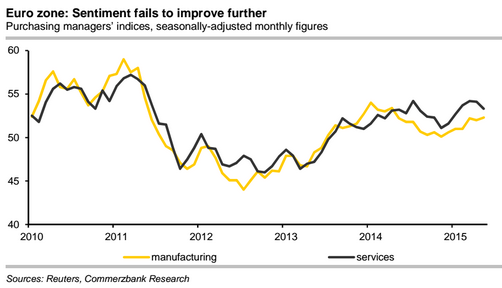

Most economists expect the euro zone economy over the course of the year to grow at an even stronger rate than in the first quarter (+0.4% month-on-month). Commerzbank believes growth will rather turn out weaker. No clear direction is evident from today's purchasing managers' indices (PMIs). While the manufacturing index rose slightly, from 52.0 to 52.3, the services index lost 0.8 points to 53.3.

The euro's depreciation and the pronounced drop in energy prices are likely to be the main reasons for decent euro zone growth. By now, however, the environment is no longer as favourable. The crude oil price has recovered somewhat and the euro is trading firmer again.

Moreover, global demand appears to keep falling, particularly from the emerging markets. In addition, the high level of private debt and exaggerations on property markets in many euro countries argue against a sustainable, strong upswing. The resulting corrections will keep weighing on the economy.

"Consequently, the speed of growth expected to decline again somewhat over the further course of the year. Growth is likely to come in at 1.2% on average this year (consensus: 1.5%)", estimates Commerzbank.

The unexpected rise in the manufacturing PMI in May, from 52.0 to 52.3, seems to prove the economic optimists right. However, the unexpectedly strong decline of the services PMI, from 54.1 to 53.3, which in the past was more closely correlated to changes in real GDP than the manufacturing index, implies that caution is warranted.

After all, this means that the increase since the start of the year has almost been corrected entirely. The ECB which is looking for growth of 1.5% is more likely to extend its bond buying programme than end it prematurely.

Euro zone's mixed economic picture

Thursday, May 21, 2015 9:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed