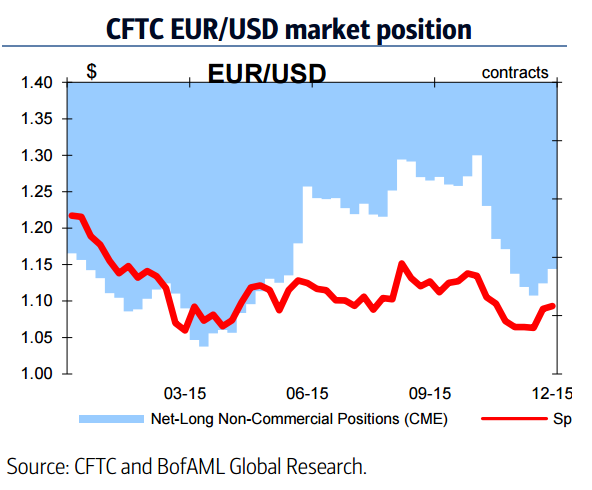

Year 2015 was definitely not a smooth path for the Euro. It started with the ECB surprising markets by announcing what came across as open-ended QE. Markets got excited and kept driving the Euro down, until the Fed pushed against the strong USD on March 18, causing a painful positioning squeeze. EUR/USD mostly stayed within a 1.10-1.15 range after the Fed's verbal intervention.

Once the ECB on October 22 hinted at the possibility of a rate cut and changes to its QE program on December 3, EUR/USD began a one-way move from above $1.1300 to below $1.0600 in just under six weeks. When the ECB failed to meet market expectations EUR/USD shorts were snapped back even quicker, and the pair flirted with $1.1100 at points between when the ECB meeting on December 3 and when this forecast was finalized on December 18. Market proved Euro bears right, EUR/USD ended the year lower. While the prospect of even higher rates in the U.S. and continued ECB stimulus will keep the euro under pressure, we could forget about parity.

"Looking ahead, we remain bearish on EUR, but expect the path to remain choppy. We project EUR/USD to weaken to 0.95 by the end of 2016. At the same time, our year ahead top contrarian trade was for short-term EUR/USD upside", outlines BoFA Merrill Lynch in a research report.

Markets focus will be on what the ECB and the Fed will do next at their respective March policy meetings. For now, EUR/USD is mostly a USD trade and much will depend on whether the Fed will hike as fast as the dot plot suggests. On the Euro side of the equation, towards the middle of the year the ECB is expected to start considering further easing, as Eurozone inflation continues disappointing.

Current fundamental conditions warrant a sideway trading environment for EUR/USD. The still short EUR market position poses some upside Euro risks in the short term. But, if the market pricing of Fed hikes and the Fed's dot plot converge somewhere in the middle as the US recovery continues and headline inflation increases towards core inflation, and at the same time Eurozone inflation remains below the ECB's targeted path, EUR/USD will eventually weaken.

"A level slightly below parity would be consistent with equilibrium estimates that adjust for differences in the business cycle. Selling EUR/USD rallies and taking profits when positioning seems stretched was a strategy that worked during 2015 and we believe will continue working in 2016", adds BoFA Merrill.

EUR/USD has broken major support at 1.0800 on the day which confirms a major trend reversal. Decline till 1.07250/1.0670/1.0620 is possible. The pair was trading at 1.0772 as of 0944 GMT.

Euro to end 2016 with a weaker tone

Tuesday, January 5, 2016 10:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate