EU Current Account printed at 18.6 billion against forecast at 26.1 billion as reported by ECB.

Highlights of today's events that may impact on Euro:

Iron Condors come into rescue in non directional trend:

The iron condor strategy can also be visualized as a combination of a bull call spread and a bear call spread.

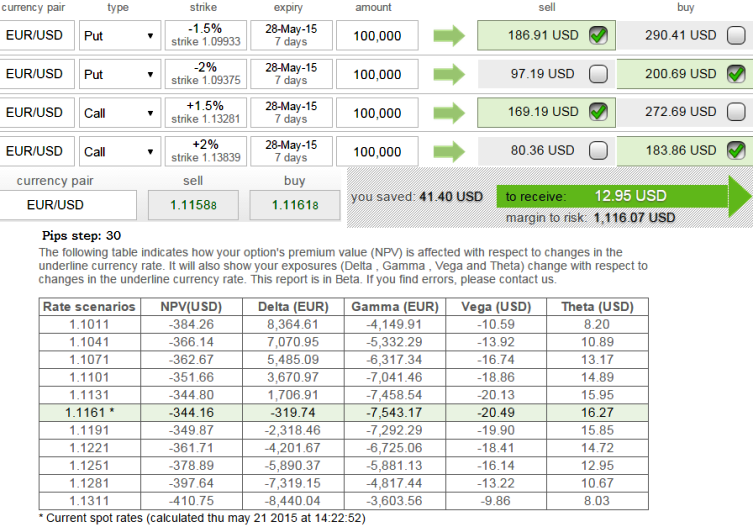

How to execute: As shown in the figure the hedger should attempt to form this multiple leg position by selling an OTM Put along with buying an even lower strike OTM put, simultaneously selling OTM call along with buying another even higher strike OTM call.

Options expiration month should be same on all contracts.

This results in a net credit to put on the trade.

The iron condor is a limited risk, non-directional option trading strategy that is designed to have a large probability of earning a small limited profit.

Euro stuck in riddle as non directional trend on cards; hedge using iron condors

Thursday, May 21, 2015 9:04 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?