Datawise, the calendar remains exceptionally light today with euro zone money supply data and the final read of US consumer sentiment for June from the University of Michigan.

Euro zone money growth is likely to have accelerated in May, reflecting both the ongoing impact of the ECB's QE programme and a recovery in bank lending to households and corporates. While Greece has been quite routine issue by default now a days.

Technical and Currency Derivatives Insights: (EURUSD):

Bearish signals have been traced out from EOD as well as intraday charts. Formation of long legged southern doji seen on EUR/USD daily charts.

No significant buying pressure is observed as the slow stochastic evidences %D crossover (%D line at 32.0361 & %K line at 23.4315).

Overall, no positive triggers that prop up Euro both on fundamental and technical standpoint.

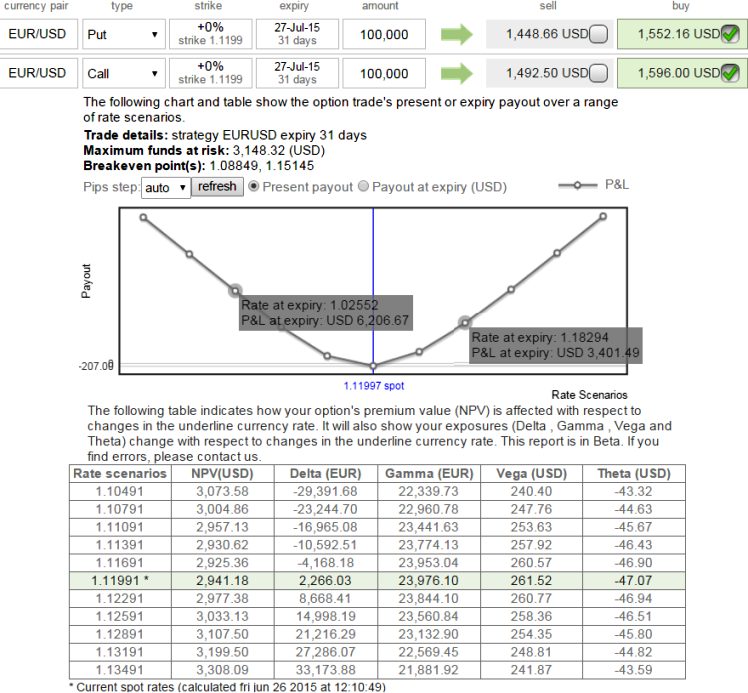

We reckon markets for Euro would be bearish bias today as a result of both fundamental and technical reasoning, Therefore we recommend arresting these downside risks through deploying below option strategy.

If you expect the underlying currency (EURUSD) to make the downside moves, then buy 2 lots of 15D (1.5%) Out-Of-The-Money puts and sell simultaneously an (1%) In-The-Money put of the same maturity.

The combined delta should have 0.38, while positive theta is preferred.

The higher strike short puts finances the purchase of the greater number of long puts and the position is entered for no cost or a net credit.

Euro bulls seem edgy; put back spreads bid speculation opportunities

Friday, June 26, 2015 10:16 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings