Stronger growth in Euro area's ULC will result in higher core inflation with higher wage growth. Based on this assumption, core inflation is expected to gradually recover to an average level of 1.3% in the medium term.

This scenario also assumes stable productivity gains of around 0.8% yoy, consistent with our projected growth potential, followed by compensation per employee growth ofclose to but below 2%.

"The ULC growth in Euro area is likely to remain sluggish, falling from 0.8% yoy in Q2 2015 to 0.5% by Q2 2016, at which point it is expected to bottom out and begin to pick up to a slighter faster pace of 0.8-1.0% between 2017 and 2019", says Societe Generale.

This implies a noticeable quickening in wage growth from the current rate (1.5% yoy), although the expected growth rate should remain below the rate seen in past economic cycles. For instance, wage growth averaged 2.8% over 2001-2007.

Obviously, if growth in compensation/employee failed to pick up pace or actually weakened, this would weigh on ULC growth and as a result reduce the core inflation outlook over the medium term.

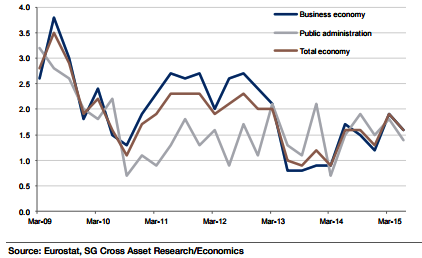

Hourly labour costs across the business economy and public administration have been in line since 2014, contrary to what was seen during the fiscal tightening between 2010 and 2013.

Euro area's wage acceleration not strong enough to boost ULC

Thursday, October 29, 2015 2:59 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed