The Greek crisis dominated events over the past month. Despite a resounding 'no' vote in the 5 July referendum on further austerity, a rapidly deteriorating economic situation meant the Greek government had little choice but to sign up to a strict reform agenda in return for a third bailout of up to €86bn. Amid heightened 'Grexit' risks, the ECB froze the emergency liquidity assistance (ELA) for Greece's banks, resulting in temporary bank closures and the imposition of capital controls. The 10-year German bund yield fell to around 0.6%, while Italian and Spanish 10-year peripheral spreads increased, though the moves were limited compared with those during the euro area debt crisis in 2012.

Intense negotiations eventually resulted in an agreement on reform measures which include tax rises, spending cuts and policies to liberalise labour and product markets. A €50bn privatisation fund is also being set up as part of the measures, partly to help recapitalise the country's banks. The ratification of the measures in the Greek parliament and in other euro area countries and the provision of a temporary bridging loan to Greece to pay IMF arrears and maturing bonds have enabled the ECB to raise the ELA and Greek banks to reopen, albeit with capital controls still in place. Grexit risks have thus subsided for now, though the issues of implementation risks and debt sustainability remain. The 10-year bund yield subsequently headed back towards 1%, although it has since fallen back below 0.8%, while peripheral spreads have narrowed substantially.

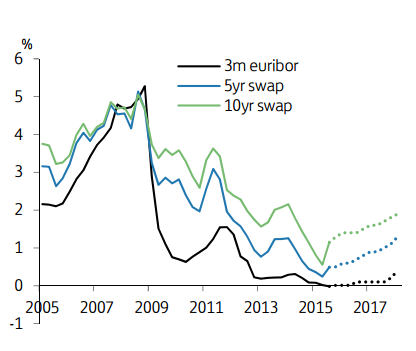

President Draghi remained relatively upbeat about euro area economic growth and inflation prospects, but warned that the ECB would act if there is an unwarranted tightening of monetary conditions. He reiterated that the return of inflation to target would require a "full implementation" of the QE programme through September 2016.

"We have maintained our target for a moderate rise in the 10-year bund yield at 1.0% by the year-end, despite bigger increases in the US and UK," says Lloyds Bank.

Euro area rates: Monthly review

Monday, July 20, 2015 10:37 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed