The past week has been eventful on both sides of the Atlantic. In Europe, Greece reached a deal with creditors for the start of negotiations for a third bailout package conditional on passing "prior actions" in the Greek parliament. The parliamentary vote was successful, even if Greek Prime Minister Tsipras lost the majority in his party and he will likely reshuffle a little within his coalition at some stage. Following the vote, a €7bn bridge financing was agreed by the creditors sourced from the EFSM with some guarantees attached to it and, as a result, the ECB also took the decision to increase the ELA allowance for Greek banks once again. All in all, the immediate default and disorderly exit risk of Greece from the euro area has been averted in the near term.

The Greek deal significantly reduces the risks of an imminent disorderly exit, the road will likely be bumpy, as the preliminary details of any new programme look harsh to implement from an economic point of view and the notable debt relief prospects are not very precise.

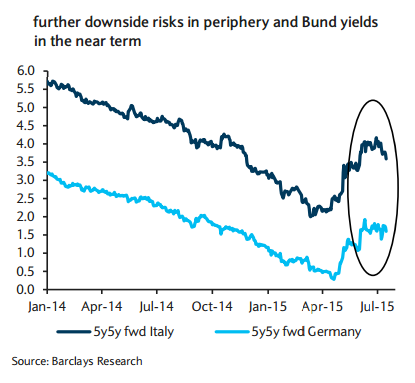

"We maintain our bullish trade ideas, namely: long 10y Bund outright, long 5y5y fwd Italy outright and long 10y Bund ASW vs EONIA," says Barclays.

Euro area rates: Weekly review

Friday, July 17, 2015 12:22 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022