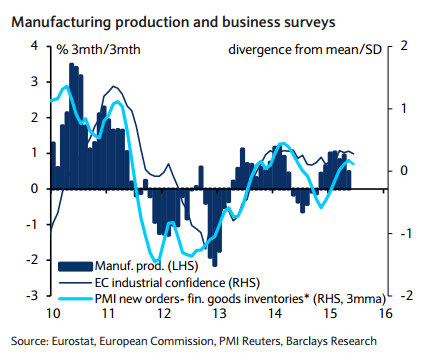

Industrial production was down 0.4% m/m in May, broadly in line with below-consensus expectations. This is consistent with an annual growth rate of 1.6% y/y, up from 0.9% y/y. April data were revised down 0.1pp to 0.0% m/m, while Q1 growth was slightly revised up to 1.0% q/q. This confirms that euro area industrial production is set to moderate in Q2, after a solid Q1 growth. The carryover of Q2 is slightly negative at -0.1% q/q, and weakness appears to be mainly driven by the energy sector, whereas manufacturing production held up better and is on course to have increased by around 0.4% q/q in Q2, broadly in line with business surveys.

"We believe that the temporary weakness in industry will be partly offset by renewed strength in the services sector, and we have kept our forecast for Q2 GDP growth unchanged at 0.4% q/q, despite a significant downward revision to Greek GDP," says Barclays.

Meanwhile, June inflation was confirmed at 0.2% y/y, in line with expectations and 0.1pp lower than in May. Both energy and food inflations came in on the weak side, while core inflation, down to 0.8% y/y, was more of a mixed bag, with services inflation revised slightly up but still at a historical low of 1.1% y/y, and non energy industrial goods inflation up from 0.2%y/y to 0.3%y/y.

The pass-through from a weaker euro continues to be seen, with the increase in imported goods prices since the end of 2014 gradually feeding into final goods inflation, although partially and with a significant time-lag.

We have revised our inflation forecasts slightly down to take into account lower oil prices and to factor in preliminary signs that unprocessed food prices' momentum may have lost some steam: we now expect headline HICP inflation to average 0.2% this year and 1.2% next under market assumptions, 0.1pp below our previous projection. Moreover, we believe that inflation will remain around current levels until September before gradually rising towards 1% y/y by year-end as a result of base effects from oil prices, added Barclays.

Euro area: Subdued recovery still underway, with downside risks on inflation

Sunday, July 19, 2015 9:58 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed