Many analysts began pondering that the launch of derivatives market for Ether will most likely have diverging consequences on the price trajectories of the top two cryptocurrencies.

To substantiate this stance, Tom Lee, a managing partner at Fundstrat Global Advisors, thinks that Ether futures trading will alter the price narrative of the market.

Last December was an eventful month for bitcoin, with investors for the first time being able to access bitcoin indirectly through futures and options made available through CME and CBOE.

That is when BTCUSD surged to almost all-time highs of $19k. But please be mindful of the price oscillation, price tumbles from the peaks of $19,697 to the recent lows of $5,755 levels, and currently attempting to bounce back again.

Amid this price developments, hedge fund flows have poured in cryptocurrencies that has had an average return of 1,522% this year, compared to an average of 7.2% for hedge funds invested in conventional assets classes.

Lee also commented further, since December, if one was bearish on any aspect of crypto but did not want to own the underlying, they could short BTC. They can now short ETH, means the net short on BTC in futures would fall.

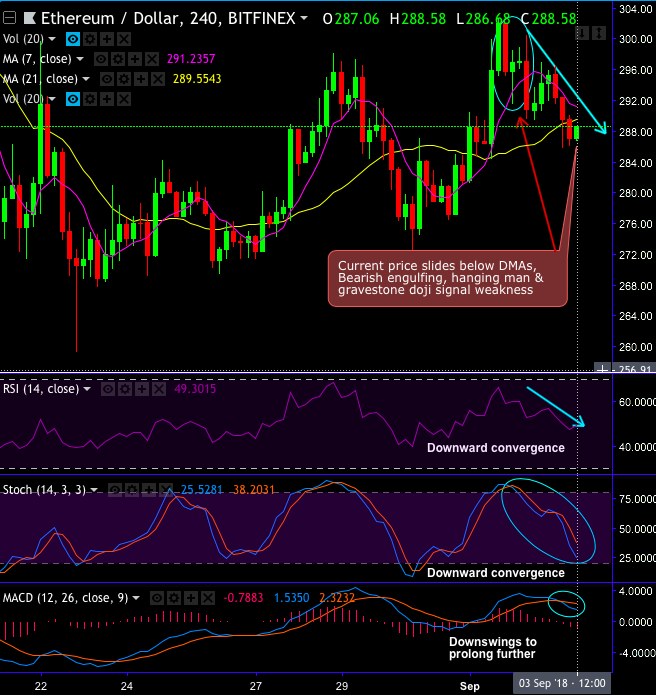

ETHUSD forms bearish engulfing, hanging man and gravestone doji at $295.72, $296.88 and $297.05 levels (refer daily chart).

After these back-to-back bearish formations, price remains constantly dipping below 7EMA levels (refer weekly chart), while both leading and lagging indicators signal strength and trend continuation in the bearish swings, for now, we could foresee more slumps on bearish EMA & MACD crossovers.

Ethereum appears nothing like before, began a true bear market by returning to the lowest levels since the fall of 2017, after rising to above $1,300 and tumbling to almost $400. Ethereum core developers appear no closer to reaching agreement on the future direction of the projects.

Overall, the major trend of ETH is still struggling and has also lost considerably since its highs of BTC prices last summer, down 50% from 0.15 BTC to 0.073 BTC.

Currency Strength Index: FxWirePro's hourly BTC spot index has shown 151 (which is bullish), while hourly USD spot index was at 64 (bullish), while articulating at 13:18 GMT. For more details on the index, please refer below weblink:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure