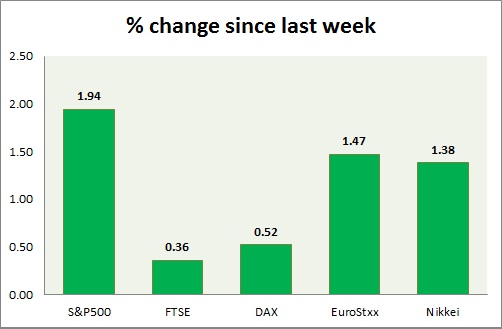

Equities are all mixed today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P 500 is marginally up, hovering just below key psychological level of 2000. Today's range 1995-1973.

- Initial jobless claims came at 265,000.

- Housing starts dropped to 1.126 million in August from 1.161 million in July. Building permits rose to 1.17 million in August from 1.12 million in July.

- S&P 500 future is currently trading at 1999. Immediate support lies at 1900 and resistance 2000.

FTSE -

- FTSE is down as BOE hawkish outlook and approaching FOMC weighed. Today's range 6170-6270.

- FTSE is currently trading at 6180. Immediate support lies at 5950 and resistance 6600.

DAX -

- DAX is flat today, as investors awaiting FOMC rate decision. Today's range 10210-10290.

- DAX is currently trading at 10240. Immediate support lies at, 9750 area and resistance at 10500 around.

EuroStxx50 -

- Stocks across Europe are mixed ahead of FOMC.

- German DAX is up (+0.02%), France's CAC40 is up (+0.37%), Italy's FTSE MIB is up (+0.14%), Portugal's PSI 20 is up (+0.29%), Spain's IBEX is up (+1.30%).

- EuroStxx50 is currently trading at 3255, down by -0.12% today. Support lies at 3000 and resistance at 3300.

Nikkei -

- Nikkei gained grounds as Yen weakened most among majors Today's range 18020-18470

- Nikkei is currently trading at 18460, with support around 16000 and resistance at 19500.

|

S&P500 |

+1.94% |

|

FTSE |

+0.36% |

|

DAX |

+0.52% |

|

EuroStxx50 |

+1.47% |

|

Nikkei |

+1.38% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?