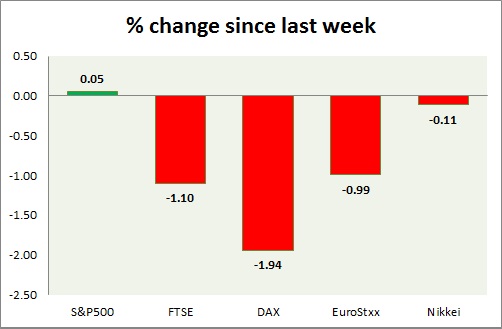

Chinese devaluation soured mood in equities. Performance this week at a glance in chart & table -

S&P 500 -

- S&P sharply down today due to sell offs over China's action to devalue currencies. Today's range 2106-2078.

- US labor productivity rose by 1.3% in July and unit labor cost rise by 0.5% according to a preliminary reading.

- S&P 500 is currently trading at 2082. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE is down due to miners' drag and global sell offs. Today's range 6655-6745.

- CB leading economic index dropped by -0.2% in July.

- FTSE is currently trading at 6660. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is down by -2.7% as investors dump equities. Today's range 11430-11600.

- Zew current sentiment improved to 65.7 in August from 63.9 in July.

- DAX is currently trading at 11290. Immediate support lies at, 11000 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are trading red today.

- Euro zone Zew economic sentiment rose to 47.6 in August from 42.7 in July.

- Germany is down (-2.7%), France's CAC40 is down (-1.9%), Italy's FTSE MIB is down (-0.9%), Portugal's PSI 20 is down (-1.72%), Spain's IBEX is down (-1.4%)

- EuroStxx50 is currently trading at 3608, down by -1.9% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is relatively better performer as weaker Yen provided some cushion.

- Nikkei is currently trading at 20630, with support around 20000 and resistance at 21000.

|

S&P500 |

+0.05% |

|

FTSE |

-1.10% |

|

DAX |

-1.94% |

|

EuroStxx50 |

-0.99% |

|

Nikkei |

-0.11% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary