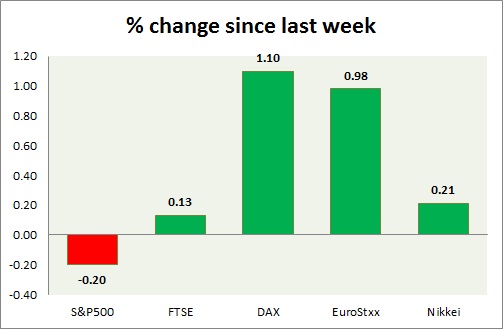

Equities remained remain mixed across region after the release of stronger data from US. Performance this week at a glance in chart & table -

- S&P 500 - US stock markets are failing to gain on the stronger US data releases as concerns are surfacing that it might trail other markets as the FED reserve are soon going to raise rates. Today's GDP data published showed that growth has weaken in the US at 2.2% from previous 2.6% but still remain strong. It is currently trading at 2109, down 0.1% for the day. Immediate support lies at 2084.

- FTSE - FTSE has sailed into new highs but so far failed to break above 7000. It is still treading water near its all-time high of 6930. FTSE is currently trading at 6941. Support lies at 6870 and facing resistance near 6965.

- DAX - DAX again moved to new highs as portfolio flows continue to go more to Germany. It is expected to be the best performer this year. It's breaking into new all-time high, currently trading at 11284, immediate support lies at 11160.

- EuroStxx50 - The gain has somewhat stalled today after the performance remained mixed across Europe. Italy is up 0.65%, Spain remains down 0.17% and DAX is flat so far. EuroStxx50 is currently trading at 3577, up 0.25% for the day. Support lies at 3485.

- Nikkei - Nikkei rolled back some of yesterday's gain as mixed economic data released last night painted mixed picture. The future almost touched 18900 yesterday. Tax excluded CPI remained at 0.2% and household spending fell further. Nikkei is trading at 18836. Immediate support lies at 18500.

|

S&P500 |

0.05% |

|

FTSE |

-0.1% |

|

DAX |

1.91% |

|

EuroStxx |

1.56% |

|

Nikkei |

1.73% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?