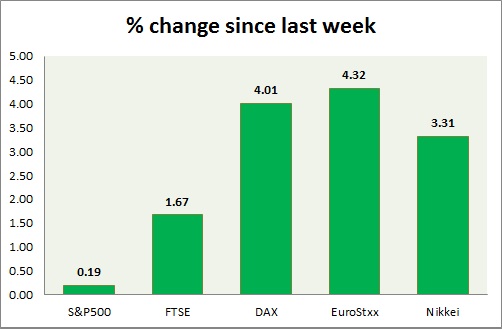

Equities are flat as Greek drama continues. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is down today as Greek uncertainty continue to persist. Today's range 2121-2106.

- US PCE price index rose by 0.03% in May on monthly basis and 1.2% on yearly basis.

- Personal income rose by 0.5% and spending by 0.9% in May.

- Initial jobless claims was at 271,000 for the week.

- S&P 500 is currently trading at 2109. Immediate support lies at 1980, 2040 and resistance 2164.

FTSE -

- Greek concern pushed FTSE down today. Today's range 6870-6798.

- FTSE is currently trading at 6807. Immediate support lies at 6700, 6050 and resistance at 7000. 6750 area is likely to provide resistance

DAX -

- DAX is flat as Greek deal still remains eluded. Today's range 11590-11350

- DAX is currently trading at 11470. Immediate support lies at 10730, 10500 and resistance at 11500 around.

EuroStxx50 -

- Stocks across Europe are all trading in mixed, bias remains downwards if Greek crisis is not contained will turn bullish if solution is reached.

- Germany is up (+0.02%), France's CAC40 is down (-0.07%), Italy's FTSE MIB is up (+0.73%).

- EuroStxx50 is currently trading at 3600, up by +0.22% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei struggles near 18 year peak as Greek failed to reach a solution with bailout monitors so far.

- Nikkei is currently trading at 20790. Key support is at 20300 and resistance at 20900 area.

|

S&P500 |

+0.19% |

|

FTSE |

+1.67% |

|

DAX |

+4.01% |

|

EuroStxx50 |

+4.32% |

|

Nikkei |

+3.31% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?