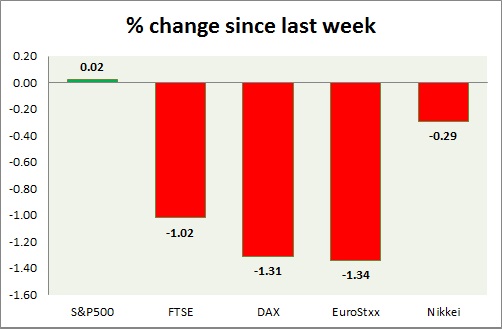

Equities are trading in red as big buying as hit market as fear of Greek contagion subsided. Performance this week at a glance in chart & table -

S&P 500 -

- S&P has sharply bounced from 2070 area. Today's range 2095-2071.

- Building permits rose to 1.275 million from 1.140 million, but housing starts dropped to 1.036 million from prior 1.165 million.

- S&P is awaiting to take further cues from FED policy.

- S&P 500 is currently trading at 2094.5. Immediate support lies at 1980, 2040 and resistance 2164.

FTSE -

- FTSE has broken below key support area of 6700, however bounced back sharply. Today's range 6720-6650. FTSE is facing key support level test as FED approaches.

- Further downside remains open. Though FED policy move will decide further move.

- FTSE is currently trading at 6710. Immediate support lies at 6050 and resistance at 7000.

DAX -

- DAX has bounced back sharply and is in the process of forming a hammer in daily chart.

- DAX is currently trading at 11060. Today's range 10800-11075. Immediate support lies at 10730, 10500 and resistance at 11500 around.

EuroStxx50 -

- Stocks across Europe are all trading in green today bouncing back from massive selloffs.

- Germany is up (+0.55%), France's CAC40 is up (+0.5%), Italy's FTSE MIB is up (+0.3%) and Spain's IBEX is up (+0.25%).

- EuroStxx50 is currently trading at 3457, up +0.20% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Nikkei is struggling as yen remains relatively strong after Kuroda comments.

- Nikkei is currently trading at 20260. Key support is at 19500 and resistance at 20900 area.

|

S&P500 |

+0.02% |

|

FTSE |

-1.02% |

|

DAX |

-1.31% |

|

EuroStxx50 |

-1.34% |

|

Nikkei |

-0.29% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?