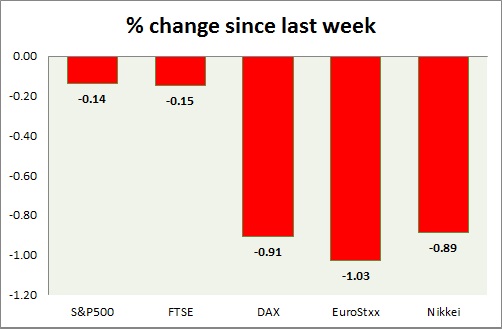

Equities are trading in red today over Greek concern and FED hike expectation over stronger Non-farm. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is down, as global sentiment deteriorated. Today's range 2088-2095.

- Risk aversion over FED hike is pushing the index lower.

- S&P 500 is currently trading at 2091. Immediate support lies at 1980, 2040, 2080 and resistance 2164.

FTSE -

- FTSE is marginally down over profit booking. Today's range 6827-6780.

- FTSE is currently trading at 6807. Immediate support lies at 6700 and resistance at 7120.

DAX -

- DAX is down, given more than 10% correction from its April high.

- DAX is trading close to crucial support at 11000 area. A break would push the index towards 10550 area. However DAX remains fundamental buy.

- DAX is currently trading at 11066. Immediate support lies at 10500 and resistance at 11700 around.

EuroStxx50 -

- Stocks across Europe are all trading in red today. Possibility of a Greek exit is fuelling the risk aversion.

- Germany is down (-1%), France's CAC40 is down (-0.96%), Italy's FTSE MIB is down (-0.32%) and Spain's IBEX is down (-1.10%).

- EuroStxx50 is currently trading at 3475, down 1% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Nikkei is struggling to push ahead as it faces headwinds from Yen strength today. Further rise is likely, however that might be hindered by global risk aversion.

- Nikkei is currently trading at 20375. Key support is at 20200, 19500 and resistance at 20900 area.

|

S&P500 |

-0.14% |

|

FTSE |

-0.15% |

|

DAX |

-0.91% |

|

EuroStxx50 |

-1.03% |

|

Nikkei |

-0.89% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?