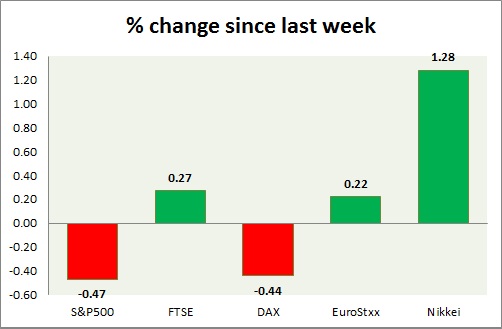

Equities are trading in green today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is gaining ground after last week's drop. Looks set to curve new all-time high.

- MBA mortgage application dropped by -1.6%.

- Redbook index dropped -0.3% m/m, up 1.6% y/y compared to 1.8% prior.

- S&P 500 is currently trading at 2114.

Immediate support lies at 1980, 2040, 2080 and resistance 2164.

FTSE -

- FTSE bulls have successfully crossed 7000 mark. Expect FTSE to move higher as UK economy will gain broadly from European Central Bank's monetary easing. Improving economic outlook is also price supportive of stocks.

- FTSE is currently trading at 7046. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX is trading in green today. GFK consumer climate moved to new record high at 10.2

- Larger buy trend is have resumed. Upside target is coming at 12600-12700 with stop at 11100.

- DAX is currently trading at 11777. Immediate support lies at 11250 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are all trading in green today.

- Germany is up (+1.20%), France's CAC40 is up (+1.82%), Italy's FTSE MIB is down (+2.07%) and Spain's IBEX is up (+1.94%).

- EuroStxx50 is currently trading at 3688, up 1.6% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Nikkei is very close to its initial target of 20800. Weaker Yen is providing the necessary support. Expect heavy profit bookings near 21000 area.

- Nikkei is currently trading at 20612. Key support is at 20200, 19500 and resistance at 20900 area.

|

S&P500 |

-0.47% |

|

FTSE |

+0.27% |

|

DAX |

-0.44% |

|

EuroStxx50 |

+0.22% |

|

Nikkei |

+1.28% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings