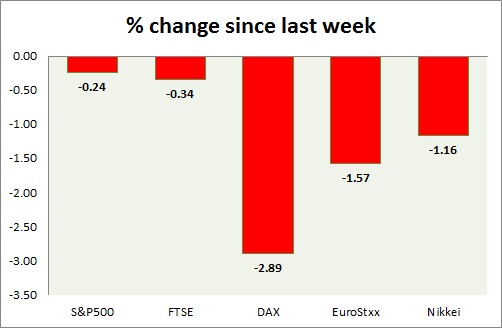

Equities are all trading in red today, driven by massive profit booking at record levels. Performance this week at a glance in chart & table -

S&P 500 -

- US benchmark facing sell offs as weaker than expected retail sales posed doubt over economic strength.

- Retail sales growth for March came at 0.9% lower than expected 1.1%.

- NFIB business confidence dropped in March to 95.2 from prior 98.

- S&P 500 is currently trading at 2086, might go down to test support near 2040. Immediate support lies at 1980, 2040 and resistance 2120, 2164.

FTSE -

- FTSE gave up gains after testing near 7100 area, flat for the day so far.

- Stronger pound failed to discourage the FTSE bulls today.

- FTSE is currently trading at 7073. Important support lies at 6700 and resistance around current price towards 7100.

DAX -

- DAX is down as Euro rose against dollar today, as investors are booking profits ahead of meeting by ECB.

- Index is trading at 12220, down nearly 1% today. Immediate support lies at 12000, 11830, 11750.

EuroStxx50 -

- Stocks across Europe are in red today. Profit bookings hit before ECB monetary policy.

- Germany is down (-1%), France's CAC40 is down (-1.1%), Italy's FTSE MIB is down (-1.2%) and Spain's IBEX is down (1.50%).

- Consumer prices in Spain and Italy rose by 2% and 2.1% m/m in March.

- EuroStxx50 is currently trading at 3780, down -0.80% today. Broader trend remains upwards. Support lies at 3635, 3545.

Nikkei -

- Profit booking intensified today as Nikkei touched 20000 levels today, almost after 15 years.

- Nikkei is currently trading at 19820. Immediate support lies at 19630, 18540 and resistance at 20000, 20800.

|

S&P500 |

-0.81% |

|

FTSE |

-0.23% |

|

DAX |

-1.34% |

|

EuroStxx50 |

-1.31% |

|

Nikkei |

-1% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings