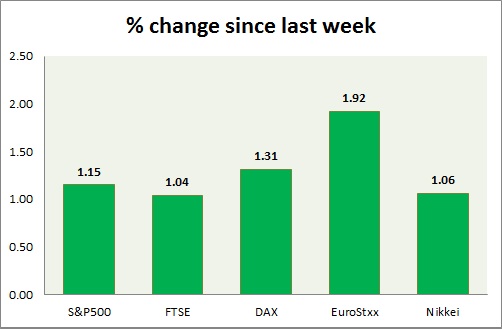

Equities are all green in today's trading. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart & table -

S&P 500 -

- S&P 500, recovered from Asian session loss to trade in green as of now. Today's range 1940-1927

- Active call - Sell S&P 500 @ 1890 with stop loss around 1960, targeting 1730 area.

- S&P 500 future is currently trading at 1939. Immediate resistance lies at 1960 and support 1900, 1870.

FTSE -

- FTSE is recovering ground as commodities rise from down day to green. Today's range 5980-6040.

- Active call - Sell FTSE100 @5890, with stop loss around 6160 area targeting 5200 area.

- FTSE is currently trading at 6010. Immediate support lies at 5500, 5200 and resistance 6150, 6350, 6820.

DAX -

- DAX is still down for the day even as S&P 500 moved to green. Today's range 9460-9580.

- DAX is currently trading at 9500. Immediate support lies at, 9000 area and resistance at 10000, 10850 around.

EuroStxx50 -

- Stocks across Europe are mixed today.

- German DAX is down (-0.8%), France's CAC40 is down (-0.3%), Italy's FTSE MIB is down (-0.11%), Spain's IBEX is up (+0.11%).

- EuroStxx50 is currently trading at 2920, down by -0.45% today. Support lies at 2400 and resistance at 3060.

Nikkei -

- Nikkei cash closed in 1% negative but future recovered, pointing to -0.4% loss. Today's range 15930-16340

- Nikkei is currently trading at 15980. Immediate support lies at 15000 and resistance at 16500, 18500.

|

S&P500 |

+1.15% |

|

FTSE |

+1.04% |

|

DAX |

+1.31% |

|

EuroStxx50 |

+1.92% |

|

Nikkei |

+1.06% |

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022