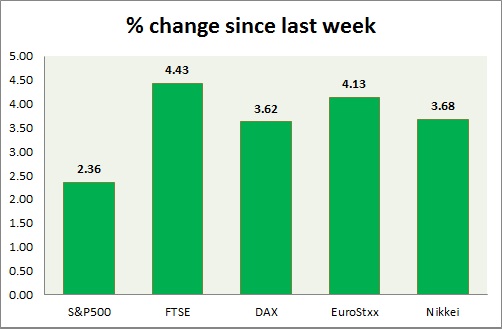

Equities are all green in today's trading. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart & table -

S&P 500 -

- S&P 500, trading in green today, amid heavy intraday swings. Today's range 1885-1910

- Active call - Sell S&P 500 @ 1890 with stop loss around 1960, targeting 1730 area.

- S&P 500 future is currently trading at 1907. Immediate resistance lies at 1890 and support 1820, 1740.

FTSE -

- FTSE is sharply higher today, shrugging off initial selling pressure. Today's range 5860-5970.

- Active call - Sell FTSE100 @5890, with stop loss around 6160 area targeting 5200 area.

- FTSE is currently trading at 5960. Immediate support lies at 5500, 5200 and resistance 6150, 6350, 6820.

DAX -

- DAX is up but lagging behind many global bourses today. Today's range 9140-9330.

- DAX is currently trading at 9320. Immediate support lies at, 8400 area and resistance at 10000, 10850 around.

EuroStxx50 -

- Stocks across Europe are green today.

- German DAX is up (+1.3%), France's CAC40 is up (+1.45%), Italy's FTSE MIB is up (+2.1%), Spain's IBEX is up (+2.3%).

- EuroStxx50 is currently trading at 2875, up by +1.25% today. Support lies at 2400 and resistance at 2850 and 3060.

Nikkei -

- Nikkei cash closed down -1.36% but future recovered in green for the day. Today's range 15610-16210

- Nikkei is currently trading at 16000. Immediate support lies at 15000 and resistance at 16500, 18500.

|

S&P500 |

+2.46% |

|

FTSE |

+4.43% |

|

DAX |

+3.62% |

|

EuroStxx50 |

+4.13% |

|

Nikkei |

+3.68% |

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed