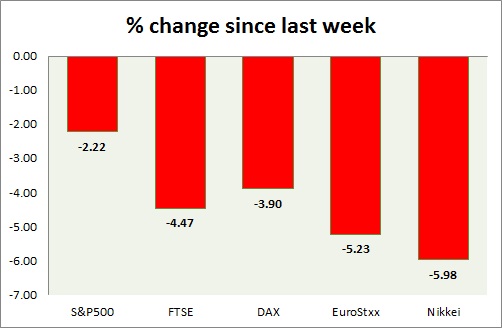

Equities are all red in today's trading. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart & table -

S&P 500 -

- S&P 500, gave up earlier gains and moved into red as US non-mfg. ISM pointed to weakness. Today's range 1918-1871

- S&P 500 future is currently trading at 1890. Immediate resistance lies at 1940, 1970 and support 1900, 1830.

FTSE -

- FTSE dropped sharply again today. Today's range 5790-5920.

- FTSE is currently trading at 5850. Immediate support lies at 5800, 5200 and resistance 6350, 6500, 6820.

DAX -

- DAX dropped sharply as S&P faltered, however on its way to recovery. Today's range 9580-9350.

- DAX is currently trading at 9460. Immediate support lies at, 9370, 8400 area and resistance at 10830, 11350 around.

EuroStxx50 -

- Stocks across Europe are red today.

- German DAX is down (-0.4%), France's CAC40 is down (-0.4%), Italy's FTSE MIB is down (-2.7%), Spain's IBEX is down (-2.4%).

- EuroStxx50 is currently trading at 2900, down by -0.7% today. Support lies at 3200 and resistance at 3550.

Nikkei -

- Nikkei dropped sharply past the level when BOJ introduced new stimulus. Today's range 16660-17480

- Nikkei is currently trading at 16830. Immediate support lies at 16300, 15000 and resistance at 17400, 18500

|

S&P500 |

-2.22% |

|

FTSE |

-4.47% |

|

DAX |

-3.90% |

|

EuroStxx50 |

-5.23% |

|

Nikkei |

-5.98% |