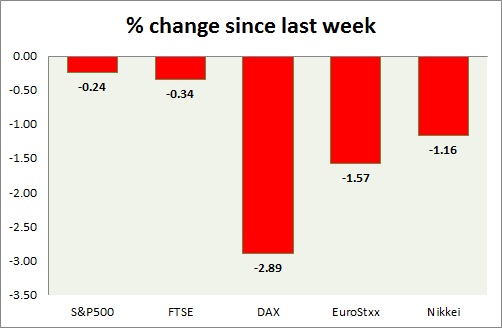

Equities are gaining today's trading however performance is diverging across board. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark has taken support at 2040 level and squared off further of the losses. Empire state manufacturing fell to 6.9 from previous 7.78. NAHB house market index fell to 53 from 55. Industrial production in February grew by 0.1%. SPX500 is currently trading at 2074, up 1.17% for the day. Immediate support lies at 2040 and resistance 2081.

- FTSE - FTSE gained in today's trading but still quite below its all-time high levels. FTSE is trading at 6804, up 0.96% for the day. Price pattern suggests the index might fall as low as 6560. Support lies at 6690 and resistance near 6860.

- DAX - DAX, is about to have another fantastic week. It has broken above 12,000 and sailed to new highs. DAX is currently trading at 12167, up nearly 2.2% for the day. Immediate support lies at 11740.

- EuroStxx50 - Stock performance is mixed across Europe. Today looks like a big buying day. Germany is up (2.2%), France's CAC40 is up (1.09%), and Italy's FTSE MIB is up (0.73%) whereas Spain's IBEX is up (0.73%). EuroStxx is currently trading at 3705, up 0.9% for the day. Support lies at 3635.

- Nikkei - Nikkei is sailing into highs benefiting from global risk on sentiment. Nikkei has broken the resistance at 19000 in today's trading and might move towards its target of 20,800. Nikkei is trading at 19450. Immediate support lies at 19200, 19000.

|

S&P500 |

1.17% |

|

FTSE |

0.62% |

|

DAX |

1.66% |

|

EuroStxx |

0.79% |

|

Nikkei |

0.92% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate