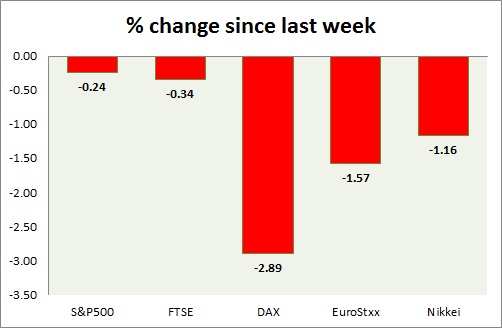

Equities are treading water in today's trading after big selloffs yesterday. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark has so far failed to gain much ground after yesterday's selloffs. However it has taken support at key level. Losses would accelerate should the level gets broken. SPX500 is currently trading at 2049, up 0.17% for the day. Immediate support lies at 2040, 1983 and resistance 2068, 2081.

- FTSE - FTSE continues to lose further ground after BOE governor Mark Carney maintained stance of rate hike yesterday and Industrial production faltered. NISER GDP estimate fell to 0.6% from previous 0.7%. FTSE is trading at 6706. Price pattern suggests the index might fall as low as 6560. Support lies at 6630 and resistance near 6750, 6860.

- DAX - DAX, best performer this month sailed to new record highs as ECB bond purchase continue to depress yields across Euro zone. DAX is currently trading at 11777, up nearly 2.50% for the day. Immediate support lies at 11400.

- EuroStxx50 - Stock performance is very positive across Europe. Germany is up (2.45%), France's CAC40 is up (2.05%), and Italy's FTSE MIB is up (2.04%) whereas Spain's IBEX is up (1.10%). EuroStxx is currently trading at 3645, up 2.08% for the day. Support lies at 3555.

- Nikkei - Nikkei has taken support of the key level and recovered from loss. Data publish late night yesterday showed Machinery orders fell by -1.9%. Nikkei is trading at 18733. Immediate support lies at 18500, 18390 and resistance at 18,900, 19000.

|

S&P500 |

-1.21% |

|

FTSE |

-2.54% |

|

DAX |

2.32% |

|

EuroStxx |

1.17% |

|

Nikkei |

-0.38% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?